Learning objectives: Distinguish among the following types of risk: absolute risk, relative risk, policy-mix risk, active management risk, funding risk, and sponsor risk. Explain the use of VaR to check manager compliance and monitor risk. Explain how VaR can be used in the development of investment guidelines and for improving the investment process. Describe the risk budgeting process and calculate risk budgets across asset classes and active managers.

Questions:

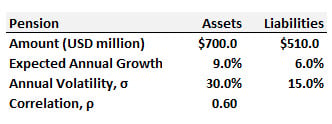

21.8.1. A pension fund carries a surplus of $190.0 million as follows:

We will assume the annual returns (on assets and liabilities) are normally distributed and their correlation coefficient is 0.60, as shown. Further, we clarify the following three definitions:

a. 99.0% rSaR = $148 million, aSaR = $115 million and worst expected shortfall = -$75 million

b. 99.0% rSaR = $225 million, aSaR = $192 million and worst expected shortfall = $2 million

c. 99.0% rSaR = $288 million, aSaR = $256 million and worst expected shortfall = $66 million

d. 99.0% rSaR = $407 million, aSaR = $375 million and worst expected shortfall = $185 million

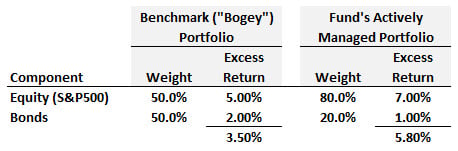

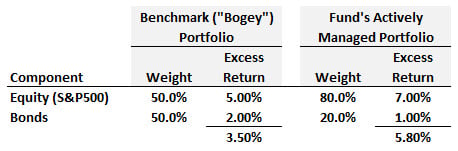

21.8.2. A fund's benchmark (aka, bogey) is a paper portfolio that is equally-weighted between Equities (i.e., the S&P 500) and a Bond index. After one year, the benchmark's excess return was +3.50%.

As displayed above, during the same period the fund's excess return was +5.80%. Let asset allocation refers to the fund's decision to vary from the benchmark's 50/50 asset allocation. Let security selection refers to the performance within an asset class; aka, active management. The fund outperformed its benchmark by +2.30%. Given this information, which of the following statements about the fund's performance is TRUE?

a. Both asset allocation and security selection (aka, active management) contributed positively to the fund's outperformance

b. Equities were a drag on the fund's performance in regard to both asset allocation and security selection, but bonds over-compensated

c. The fund's outperformance is due to a reduction in both policy-mix risk and active-management risk

d. Neither asset allocation nor security selection (aka, active management) contributed positively to the fund's outperformance

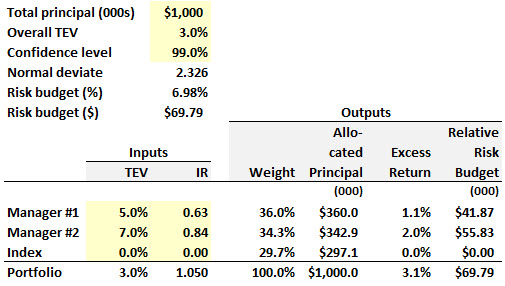

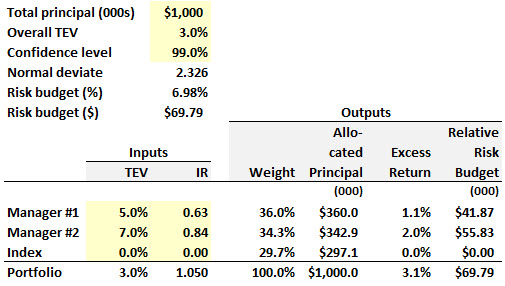

21.8.3. The State Public Employee Retirement Fund (SPERF) needs to allocate $1.0 billion to its equity fund. This amount will be sub-allocated to two active managers. SPERF has determined that its tracking error volatility (Overall TEV; aka, active risk) must be constrained to 4.0%. Manager #1 has a 5.0% TEV with an information ratio (IR) of 0.63. Manager #2 has a 7.0% TEV with an information ratio (IR) of 0.84. The managers' returns are independent; i.e., assume zero correlation. Displayed below are the assumptions and the resulting optimal allocation.

The above allocation represents the solution to an optimization problem: subject to the TEV constraint, SPERF seeks to maximize the Portfolio's information ratio (IR). Does it appear that this optimization is correct (best answer)?

a. No, the obvious flaw is that the allocation to the Index should be zero (otherwise the IR is not maximized)

b. No, the obvious flaw is that the Overall TEV of 4.0% cannot be less than each Manager's TEV (5.0% and 7.0%)

c. Yes, this appears to be correct because the relative risk budgets are proportional to the information ratio

d. Yes, this appears to be correct because the Index is allocated a relative risk budget of zero

Answers here:

Questions:

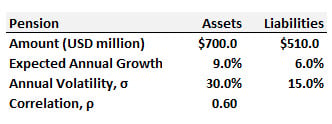

21.8.1. A pension fund carries a surplus of $190.0 million as follows:

We will assume the annual returns (on assets and liabilities) are normally distributed and their correlation coefficient is 0.60, as shown. Further, we clarify the following three definitions:

- The relative surplus at risk (rSaR) is the worst expected loss (with 99.0% confidence, in this case) relative to the expected surplus at the end of the year

- The absolute surplus at risk (aSaR) is the worst expected loss (with 99.0% confidence, in this case) relative to the surplus at the beginning of the year

- The worst expected shortfall is the worst expected negative surplus (i.e., relative to zero) at the end of the year

a. 99.0% rSaR = $148 million, aSaR = $115 million and worst expected shortfall = -$75 million

b. 99.0% rSaR = $225 million, aSaR = $192 million and worst expected shortfall = $2 million

c. 99.0% rSaR = $288 million, aSaR = $256 million and worst expected shortfall = $66 million

d. 99.0% rSaR = $407 million, aSaR = $375 million and worst expected shortfall = $185 million

21.8.2. A fund's benchmark (aka, bogey) is a paper portfolio that is equally-weighted between Equities (i.e., the S&P 500) and a Bond index. After one year, the benchmark's excess return was +3.50%.

As displayed above, during the same period the fund's excess return was +5.80%. Let asset allocation refers to the fund's decision to vary from the benchmark's 50/50 asset allocation. Let security selection refers to the performance within an asset class; aka, active management. The fund outperformed its benchmark by +2.30%. Given this information, which of the following statements about the fund's performance is TRUE?

a. Both asset allocation and security selection (aka, active management) contributed positively to the fund's outperformance

b. Equities were a drag on the fund's performance in regard to both asset allocation and security selection, but bonds over-compensated

c. The fund's outperformance is due to a reduction in both policy-mix risk and active-management risk

d. Neither asset allocation nor security selection (aka, active management) contributed positively to the fund's outperformance

21.8.3. The State Public Employee Retirement Fund (SPERF) needs to allocate $1.0 billion to its equity fund. This amount will be sub-allocated to two active managers. SPERF has determined that its tracking error volatility (Overall TEV; aka, active risk) must be constrained to 4.0%. Manager #1 has a 5.0% TEV with an information ratio (IR) of 0.63. Manager #2 has a 7.0% TEV with an information ratio (IR) of 0.84. The managers' returns are independent; i.e., assume zero correlation. Displayed below are the assumptions and the resulting optimal allocation.

The above allocation represents the solution to an optimization problem: subject to the TEV constraint, SPERF seeks to maximize the Portfolio's information ratio (IR). Does it appear that this optimization is correct (best answer)?

a. No, the obvious flaw is that the allocation to the Index should be zero (otherwise the IR is not maximized)

b. No, the obvious flaw is that the Overall TEV of 4.0% cannot be less than each Manager's TEV (5.0% and 7.0%)

c. Yes, this appears to be correct because the relative risk budgets are proportional to the information ratio

d. Yes, this appears to be correct because the Index is allocated a relative risk budget of zero

Answers here: