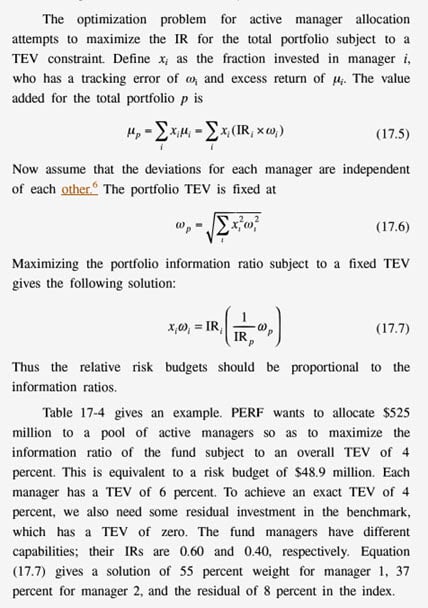

Hello @David Harper CFA FRM . Can you please explain how did you calculate weights for maximizing portfolio information ratio i,e 55%, 37% and 8% respectively in the example given on page 37 of Jorion, Chapter 17: VaR and Risk Budgeting. As per the formula provided before the example, we are required to input IR(p) in the formula to arrive at the w(i). However, the IR(p) itself depends on the calculation of weights to arrive at the active return before IR can be calculated.

Can you please guide where I am going wrong in my calculations.?

Regards,

Can you please guide where I am going wrong in my calculations.?

Regards,