You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Part 1, Topic 4: Valuation and Risk Models - Review

- Thread starter mh2452

- Start date

@Nicole Manley i'm not sure which question to which @mh2452 refers, maybe it's this? XLS https://www.dropbox.com/s/tb1ob2dmyp858m4/0405-three-bond-es.xlsx?dl=0

can you take a look? thanks,

can you take a look? thanks,

@mh2452

Can you confirm that this is the question that you are referring to in the video? Knowing exactly which question saves us time and helps us to make sure we are responding to you with the correct information.

Thank you,

Nicole

Can you confirm that this is the question that you are referring to in the video? Knowing exactly which question saves us time and helps us to make sure we are responding to you with the correct information.

Thank you,

Nicole

Thank you @Nicole Manley !

@mh2452 if Nicole is correct, then here is a version of that Q&A http://trtl.bz/0509-garp2010-p1-16

@mh2452 if Nicole is correct, then here is a version of that Q&A http://trtl.bz/0509-garp2010-p1-16

Hi David,

With reference to the 1st video review for this topic and the question discussed at 3 minutes 40 seconds. Can you please clarify how we got the 95% confidence level and the correlation. These appear to be inputs in the worksheet yet the have not been provided in the question itself. Thanks

With reference to the 1st video review for this topic and the question discussed at 3 minutes 40 seconds. Can you please clarify how we got the 95% confidence level and the correlation. These appear to be inputs in the worksheet yet the have not been provided in the question itself. Thanks

Hi @rajawasiq

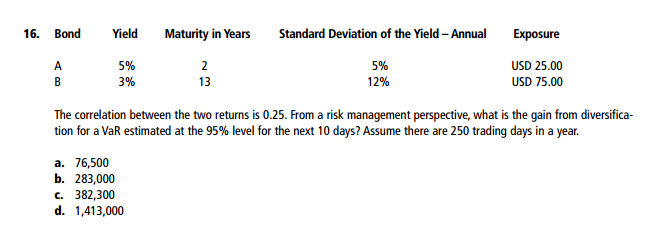

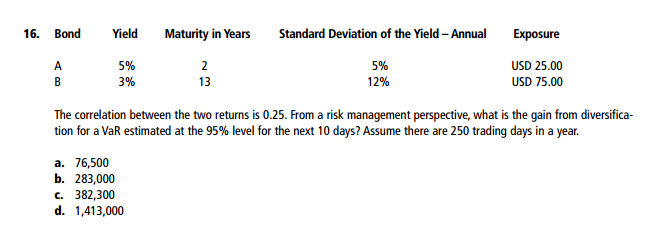

It's my fault, sorry, I totally omitted the actual question from the practice exam (see below) which is "The correlation between the two returns is 0.25. From a risk management perspective, what is the gain from diversification for a VaR estimated at the 95% level for the next 10 days? Assume there are 250 trading days in a year." BTW, the XLS above does solve this; e.g., with correlation = 0, instead, diversified 10-VaR = 37.93

It's my fault, sorry, I totally omitted the actual question from the practice exam (see below) which is "The correlation between the two returns is 0.25. From a risk management perspective, what is the gain from diversification for a VaR estimated at the 95% level for the next 10 days? Assume there are 250 trading days in a year." BTW, the XLS above does solve this; e.g., with correlation = 0, instead, diversified 10-VaR = 37.93

Similar threads

- Replies

- 16

- Views

- 2K

- Replies

- 0

- Views

- 26

- Replies

- 0

- Views

- 338