I have 2 queries with respect to some concepts in FRM Part 1, Valuation & Risk Model GARP study book 2020/ 2021.

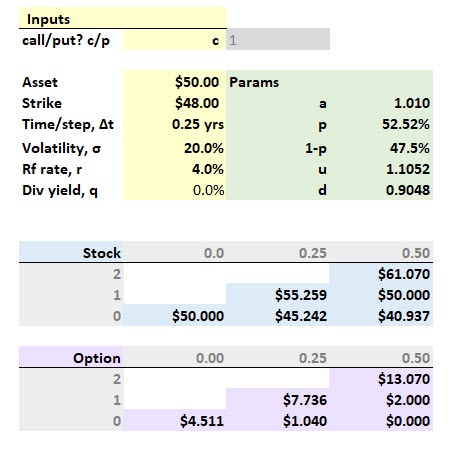

1. In the practice question no. 14.15 in chapter 14 - Binomial Trees. The question states that options maturity is 6 months and requires 2 step Binomial Tree. Volatility is 20% per annum. As per solution given in the book, for the first time step (i.e. 3 months) up option price is calculated as 55.259 which is based on annual volatility of 20% divided by 2 (for 6 months). Should it not be divided by 4 given that time duration is 3 months?

2. In the same question, annual volatility is being calculated by dividing it by the number of periods in the year. But in an example in the chapter under section 14.5 (Other Assets), and under sub section Stock Indices which involves valuing a Eur Call option on Stock Index worth 2500 USD with 15% volatility per annum and 1 month maturity, up and down prices for the tree are calculated with annual volatility multiplied by the square root of time (i.e. sq root of 1 month/ 12 months). Why is this not done in practice question no. 14.15 where annual volatility is multiplied by 0.5 (for 6 months) instead of square root of 0.5?

1. In the practice question no. 14.15 in chapter 14 - Binomial Trees. The question states that options maturity is 6 months and requires 2 step Binomial Tree. Volatility is 20% per annum. As per solution given in the book, for the first time step (i.e. 3 months) up option price is calculated as 55.259 which is based on annual volatility of 20% divided by 2 (for 6 months). Should it not be divided by 4 given that time duration is 3 months?

2. In the same question, annual volatility is being calculated by dividing it by the number of periods in the year. But in an example in the chapter under section 14.5 (Other Assets), and under sub section Stock Indices which involves valuing a Eur Call option on Stock Index worth 2500 USD with 15% volatility per annum and 1 month maturity, up and down prices for the tree are calculated with annual volatility multiplied by the square root of time (i.e. sq root of 1 month/ 12 months). Why is this not done in practice question no. 14.15 where annual volatility is multiplied by 0.5 (for 6 months) instead of square root of 0.5?