Hi David,

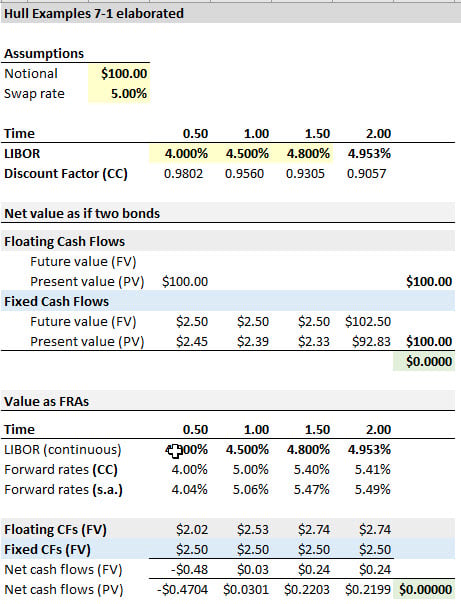

while going through the video and slides, I had a question the LOS regarding explain "Explain how the discount rates in a plain vanilla interest rate swap are computed.". in the two examples, 9th and 10th edition, why does the first boot strap of the libor spot rate compute to a final PV of 100 and then solve for z4 but the 10th edition example, that uses OIS discount rate, do a difference in the swap and libor forward rate and solve for z4 post computing a final PV of 0. could we have done the 10th edition example as only taking coupons discounted by OIS and solved for a PV of 100 and then calculated z4? please explain. Thanks.

while going through the video and slides, I had a question the LOS regarding explain "Explain how the discount rates in a plain vanilla interest rate swap are computed.". in the two examples, 9th and 10th edition, why does the first boot strap of the libor spot rate compute to a final PV of 100 and then solve for z4 but the 10th edition example, that uses OIS discount rate, do a difference in the swap and libor forward rate and solve for z4 post computing a final PV of 0. could we have done the 10th edition example as only taking coupons discounted by OIS and solved for a PV of 100 and then calculated z4? please explain. Thanks.