dlrm

New Member

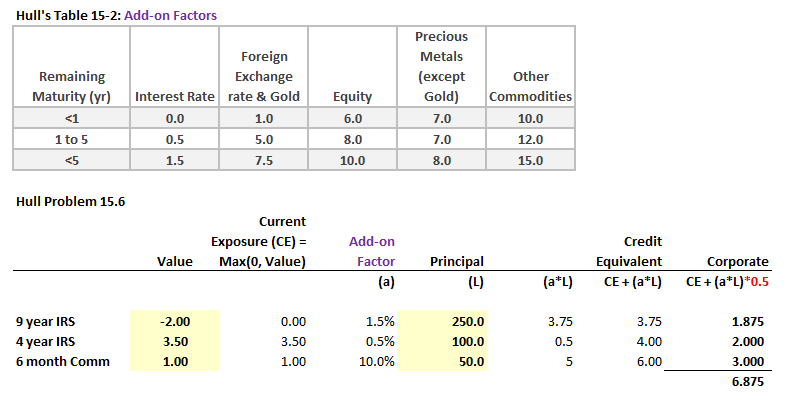

15.6 Estimate the capital required under Basel I for a bank that has the following transactions with a corporation. Assume no netting.

a. A nine-year interest rate swap with a notional principal of $250 million and a current market value of −$2 million.

b. A four-year interest rate swap with a notional principal of $100 million and a current value of $3.5 million.

c. A six-month derivative on a commodity with a principal of $50 million that is currently worth $1 million.

The risk-weighted assets for the three transactions are (a) $ 1.875 million, (b) $ 2 million, and (c) $ 3 million for a total of $ 6.875 million. The capital required is 0.08 × 6.875 or $ 0.55 million.

--

Could you please explain this calculations. For example, for (a) - for 9y int.rate swap we use addon factor 1.5%, so we have RWA=250*0.015=3.75, why the answer is 1.875?

a. A nine-year interest rate swap with a notional principal of $250 million and a current market value of −$2 million.

b. A four-year interest rate swap with a notional principal of $100 million and a current value of $3.5 million.

c. A six-month derivative on a commodity with a principal of $50 million that is currently worth $1 million.

The risk-weighted assets for the three transactions are (a) $ 1.875 million, (b) $ 2 million, and (c) $ 3 million for a total of $ 6.875 million. The capital required is 0.08 × 6.875 or $ 0.55 million.

--

Could you please explain this calculations. For example, for (a) - for 9y int.rate swap we use addon factor 1.5%, so we have RWA=250*0.015=3.75, why the answer is 1.875?