Dear David,

It is my first time to encounter such term as "percentile and uniform distribution VAR" when doing question 20 (appended at the end) in Annotated II Power Practice. I'm used to the percentage VAR which is usually expressed with the confidence level. However, when I used this approach to calculate the answer for this question, I see that my answer has some serious discrepancy with the answer provided by you.

1) I'm having difficulty understanding how you calculated the VAR for the uniform distribution mentioned in the question. For a interval of [0,100] with equal probability of each value in between, shouldn't we assign 95% confidence level to 95 since [0,95] covers the first 95% probability? Just like what we would do with a cumulative distribution function?

2) for 20b, What exactly is the maximum expected loss from model risk at the 95th percentile? I simply multiplied 1.645 with the standard deviation for the model risk (5mm): 5*1.645 = 8.225 mm, but it seems that I have made a fundamental mistake of not being able to differentiate the percentile and percentage. How do a 95% percentile VAR differ from a 95% confidence VAR? Would we see this kind of "percentile VAR" appearing in the FRM 09 exam as I'm really thinking that this could not a "mainstream" topic?

Thanks Liming 17/11/09

Question 20:

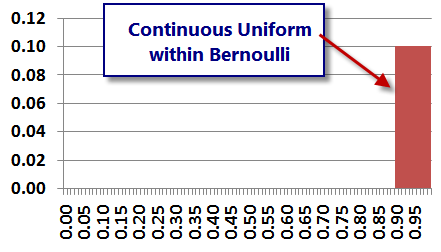

Consider the following potential operational risks. Due to a rogue trader, we estimate that over a 1 year period there is a 10% chance we could lose anywhere between € 0 and € 100MM (equal probability for all points within that range and 0 probability of any losses outside that range). Due to model risk, we estimate that over a 1 year period there is a 20% chance that we will lose € 25MM normally distributed with a standard deviation of € 5MM. Which of the following statements is true?

a. The expected loss from a rogue trader is less than the expected loss from model risk.

b. The expected loss from a rogue trader is greater than the expected loss from model risk.

c. The maximum unexpected loss from a rogue trader at the 95% confidence level is less than the maximum unexpected loss at the 95% confidence level from model risk.

d. The maximum unexpected loss at the 95% level from a rogue trader is greater than the maximum unexpected loss at the 95% level from model risk.

20b [my adds]. What exactly is the maximum expected loss from model risk at the 95th percentile?

Answer:

20. CORRECT: D. This question tests understanding of expected vs. unexpected loss. The rogue trader has an expected loss (severity multiplied by probability) of €5MM while the model risk has an expected loss of €5MM. Therefore both A and B are incorrect. We therefore must examine unexpected losses. The rogue trader has a much wider distribution (Uniform) and a lower probability of occurrence than the model risk (normal distribution). Therefore the rogue trader has a greater risk of unexpected losses.

Unexpected loss for rogue trader at 95% confidence level: 50MM - 5MM = 45MM

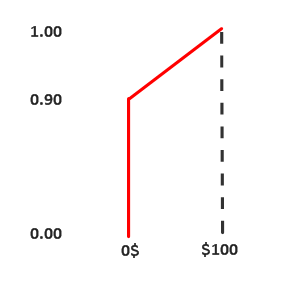

The loss from model risk at the 95th percentile corresponds to the 75th percentile for the normal distribution with mean 25 and standard deviation 5, so unexpected loss for model risk at 95% confidence level: < (25MM + 1.645*5MM) - 5MM < 30MM. Reference: Dowd, Chapter 16.

20b [my adds]. What exactly is the maximum expected loss from model risk at the 95th percentile? As the 5% loss tail for the entire distribution corresponds to the 25% of the normal distribution (i.e., 25% of the normal “tail” * 20% of the overall “parent” = 5%), we need the normal inverse at 75%: =NORMSINV(75%) = 0.675 0.675 * $5 MM + $25 MM mean = $28.372 So that max EL = $28.372 - $5 = $23.372 UL

It is my first time to encounter such term as "percentile and uniform distribution VAR" when doing question 20 (appended at the end) in Annotated II Power Practice. I'm used to the percentage VAR which is usually expressed with the confidence level. However, when I used this approach to calculate the answer for this question, I see that my answer has some serious discrepancy with the answer provided by you.

1) I'm having difficulty understanding how you calculated the VAR for the uniform distribution mentioned in the question. For a interval of [0,100] with equal probability of each value in between, shouldn't we assign 95% confidence level to 95 since [0,95] covers the first 95% probability? Just like what we would do with a cumulative distribution function?

2) for 20b, What exactly is the maximum expected loss from model risk at the 95th percentile? I simply multiplied 1.645 with the standard deviation for the model risk (5mm): 5*1.645 = 8.225 mm, but it seems that I have made a fundamental mistake of not being able to differentiate the percentile and percentage. How do a 95% percentile VAR differ from a 95% confidence VAR? Would we see this kind of "percentile VAR" appearing in the FRM 09 exam as I'm really thinking that this could not a "mainstream" topic?

Thanks Liming 17/11/09

Question 20:

Consider the following potential operational risks. Due to a rogue trader, we estimate that over a 1 year period there is a 10% chance we could lose anywhere between € 0 and € 100MM (equal probability for all points within that range and 0 probability of any losses outside that range). Due to model risk, we estimate that over a 1 year period there is a 20% chance that we will lose € 25MM normally distributed with a standard deviation of € 5MM. Which of the following statements is true?

a. The expected loss from a rogue trader is less than the expected loss from model risk.

b. The expected loss from a rogue trader is greater than the expected loss from model risk.

c. The maximum unexpected loss from a rogue trader at the 95% confidence level is less than the maximum unexpected loss at the 95% confidence level from model risk.

d. The maximum unexpected loss at the 95% level from a rogue trader is greater than the maximum unexpected loss at the 95% level from model risk.

20b [my adds]. What exactly is the maximum expected loss from model risk at the 95th percentile?

Answer:

20. CORRECT: D. This question tests understanding of expected vs. unexpected loss. The rogue trader has an expected loss (severity multiplied by probability) of €5MM while the model risk has an expected loss of €5MM. Therefore both A and B are incorrect. We therefore must examine unexpected losses. The rogue trader has a much wider distribution (Uniform) and a lower probability of occurrence than the model risk (normal distribution). Therefore the rogue trader has a greater risk of unexpected losses.

Unexpected loss for rogue trader at 95% confidence level: 50MM - 5MM = 45MM

The loss from model risk at the 95th percentile corresponds to the 75th percentile for the normal distribution with mean 25 and standard deviation 5, so unexpected loss for model risk at 95% confidence level: < (25MM + 1.645*5MM) - 5MM < 30MM. Reference: Dowd, Chapter 16.

20b [my adds]. What exactly is the maximum expected loss from model risk at the 95th percentile? As the 5% loss tail for the entire distribution corresponds to the 25% of the normal distribution (i.e., 25% of the normal “tail” * 20% of the overall “parent” = 5%), we need the normal inverse at 75%: =NORMSINV(75%) = 0.675 0.675 * $5 MM + $25 MM mean = $28.372 So that max EL = $28.372 - $5 = $23.372 UL