FlorenceCC

Member

Hi

I have a couple of questions on the syllabus for chapter 7 as detailed below:

(1) when we talk about computing the test statistic for a single regression coefficient, we specify that it follows a student's t distribution with n-k-1 df (p43). Which we will compare against the corresponding critical t. Yet, when we talk about confidence interval, we mention for instance for instance that the critical value at 5% significance is 1.96, i.e. the z value. Wouldn't the appropriate critical value be the t at n-k-1 df? I believe that in application of the CLT, with a sufficiently large sample, it is ok to use a z value. My question would be more, within the context of the exam or a question, will it be made clear whether we should be "conservative" and find the critical t, or if the question expects us to use a z value?

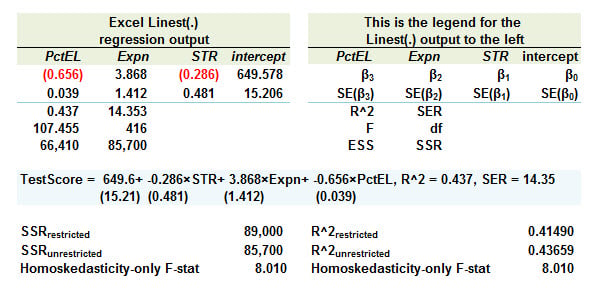

(2) On p46, the "overall" F statistic is explained as testing the joint hypothesis that all the slope coefficients are equal to 0. However I don't see a formula for it, which I found elsewhere as [(ESS/k)/(SSR/n-k-1)]. Is that a testable formula of the FRM?

Many thanks in advance for your feedback.

Florence

I have a couple of questions on the syllabus for chapter 7 as detailed below:

(1) when we talk about computing the test statistic for a single regression coefficient, we specify that it follows a student's t distribution with n-k-1 df (p43). Which we will compare against the corresponding critical t. Yet, when we talk about confidence interval, we mention for instance for instance that the critical value at 5% significance is 1.96, i.e. the z value. Wouldn't the appropriate critical value be the t at n-k-1 df? I believe that in application of the CLT, with a sufficiently large sample, it is ok to use a z value. My question would be more, within the context of the exam or a question, will it be made clear whether we should be "conservative" and find the critical t, or if the question expects us to use a z value?

(2) On p46, the "overall" F statistic is explained as testing the joint hypothesis that all the slope coefficients are equal to 0. However I don't see a formula for it, which I found elsewhere as [(ESS/k)/(SSR/n-k-1)]. Is that a testable formula of the FRM?

Many thanks in advance for your feedback.

Florence