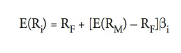

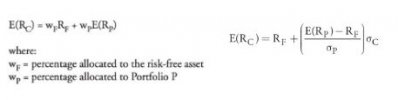

The CML contains ONLY efficient portfolios (and plots return against volatility; aka, total risk) while the SML plots any portfolio (and plots return against beta; aka, systematic risks) including inefficient portfolios.

The XLS David used in the video is located here https://trtl.bz/2Fru70r

The XLS David used in the video is located here https://trtl.bz/2Fru70r

Last edited: