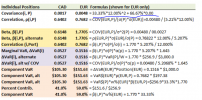

@David Harper CFA FRM Hey David. I am having difficultly in understanding the formula for calculating the Covariance of Assets with the Portfolio i.e. Cov(i,p). As per your example in the study notes, you have shown the formula for COV(euro, portfolio) which is confusing. What if the correlation is not 0 but any number between 0 and 1? how will we calculate the covariance in that scenario?

This concept is really important as we use covariance to calculate the beta of asset as well.

Looking forward to your reply.

This concept is really important as we use covariance to calculate the beta of asset as well.

Looking forward to your reply.