In our latest Week in Financial Education (WIFE), Richie's new video helpfully reviews a series of duration questions, including modified, Macaulay, money duration and price value of basis point (PVBP; aka, PV01). Compared to the FRM, the CFA's approach to duration differs only slightly. The formulas are essentially similar. The CFA's modified duration is analytical (e.g., solved functionally) while its approximate modified duration is called effective duration in the FRM (i.e., approximated or simulated by shocking an interest rate factor). The CFA's approximate modified duration shocks the yield (reprices the bond) while its effective duration instead re-prices a term structure (aka, benchmark curve). However--as far as I can tell--both are parallel shifts (geeky note: a parallel shift implies single-factor but single-factor models can be non-parallel). For myself, I do not view the CFA's distinction between approximate modified duration and effective duration (which are both effective duration in the FRM; the FRM starts from a fairly generalized interest rate factor/vector) as highly consequential. They are both durations approximated via a parallel shift. New learners should be able to see that most of these vocabularies refer to different approaches around the same single concept, but measured in different ways (as a percentage, a time/maturity, or a dollar implication). You've got to do the practice just like Richie shows us. Finally, the FRM's dollar duration is called money duration in the CFA. It gets less attention (mathematically this is the tangent line's negated slope, less prone to interpretation, but it's just a rescaled PVBP * 10,000 because there are 10,000 basis points in 100.0%) but money duration/PVBP are arguably the most useful because we use them to hedge.

I hope you like the new practice question sets. I am happy with the code snippet that illustrates an antithetic variate: you don't need code background to follow this super simple example. Question 21.6.2. also employs a code snippet, but notice how you don't really need it to answer the question! I am trying to give us practice that is useful. Simulation is not a passive reading exercise, it is done in code. You can spend an entire day reading about bootstrapping and you may never learn it. Bootstrapping is truly a doing thing. I actually put much effort into writing brief snippets (with comments) in the hopes they serve you with realistic examples. Have a good study week!

New YouTube

I hope you like the new practice question sets. I am happy with the code snippet that illustrates an antithetic variate: you don't need code background to follow this super simple example. Question 21.6.2. also employs a code snippet, but notice how you don't really need it to answer the question! I am trying to give us practice that is useful. Simulation is not a passive reading exercise, it is done in code. You can spend an entire day reading about bootstrapping and you may never learn it. Bootstrapping is truly a doing thing. I actually put much effort into writing brief snippets (with comments) in the hopes they serve you with realistic examples. Have a good study week!

New YouTube

- Tackling classic duration questions https://trtl.bz/3vdIagw

- P1.T2.21.6 Bootstrapping and antithetic/control variates https://trtl.bz/3fcvDEo

- P2.T9.21.6. Marginal value at risk (VaR) in portfolio management https://trtl.bz/3ubMtaz

- May Part 1 FRM exam feedback: https://forum.bionicturtle.com/threads/may-2021-part-1-exam-feedback.23842/

- May Part 2 FRM exam feedback (continued) https://forum.bionicturtle.com/threads/may-2021-part-2-exam-feedback.23825/

- [P1.T1] Does value at risk (VaR) favor short horizons? https://trtl.bz/34alHoC

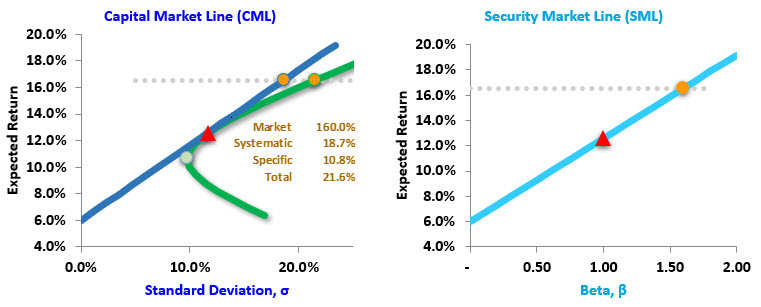

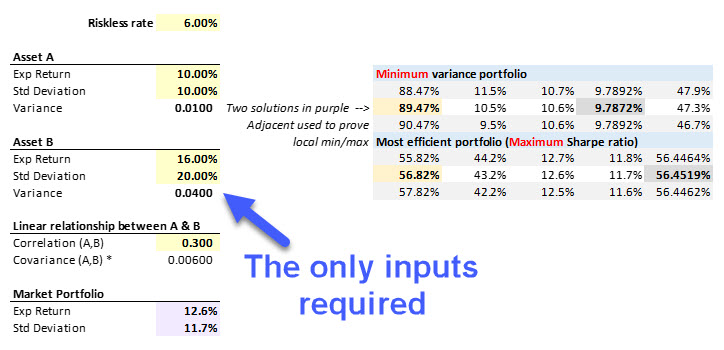

- [P1.T1] Capital market line (CML) https://trtl.bz/3ubTV5O

- [P1.T2] Power is conditional on false null, p-value is conditional on a true null (is why power is harder to estimate) https://trtl.bz/2ShztTG

- [P1.T2] The Box-Pierce joint test of autocorrelations assumes the sample correlations (aka, ACF) is asymptotically normal https://trtl.bz/3ve1muB

- [P1.T2] Brute force illustration of quarterly trend model https://trtl.bz/3vrrDFX

- [P1.T3. GARP PQ] What are the impacts of liquidity and transaction costs on forward/futures contracts? https://trtl.bz/3u84BCo

- [P1.T3] Insurance company balance sheet https://trtl.bz/3oFTxvd

- [P1.T4] Bond-equivalent basis (i.e., per annum with semi-annul compounding) is a mere but relevant convention https://trtl.bz/3fa7Q8a

- [P1.T4] Absolute versus relative value at risk (VaR) https://trtl.bz/3uih0Ui

- [P2.T6] Is it better to use spread or hazard rate for CVA approximation? https://trtl.bz/3udPVBJ

- [P2.T6] Gregory's model for overall exposure given threshold and MTA assumptions https://trtl.bz/347xKTC

- [P2.T6] Comparing Gregory's marginal/incremental CVA to Crouhy's marginal/incremental capital https://trtl.bz/3veeIHh

- Risk

- Quantifying culture and its implications for bank riskiness https://trtl.bz/3yz4i6Y "Organizational culture is both pervasive and elusive ... a bank’s culture is a leading indicator of its risk."

- The Future of Risk, Capital and Margin Reporting (ISDA) https://www.isda.org/2021/05/20/the-future-of-risk-capital-and-margin-reporting/ (pdf here)

- 10 Attributes that made ERM successful at the LEGO Group (Carol Williams) https://www.erminsightsbycarol.com/attributes-successful-erm-lego/ "ERM should ultimately help the company develop a competitive advantage through intelligent risk-taking and not just risk aversion. In the end, companies who fail to take risks in an informed way will end up being eventually displaced by more agile competitors."

- Verisk Maplecroft’s Environmental Risk Outlook 2021 https://trtl.bz/3yygfd3 (pdf here)

- Where should risk management be discussed? Full board or a committee of the board? (Normal Marks) https://trtl.bz/3hPFnX1

- Finance & Investing

- How to Avoid Foolish Behavior https://www.evidenceinvestor.com/how-to-avoid-foolish-behaviour/ "the desire to be above average leads investors to trade too much, and how costly a mistake that can be"

- Interactive tutorial on inflation by the European System of Central Banks (ESCB) https://www.euro-area-statistics.org/digital-publication/statistics-insights-inflation/

- Coasian Finance (Marc Rubinstein at Net Interest) https://www.netinterest.co/p/coasian-finance "Coase’s insight, which may seem obvious but has far-reaching implications, is that transacting is not a costless activity ... This insight explains a lot of the trends underpinning fintech."

- Robinhood is Democratizing IPOs https://blog.robinhood.com/news/2021/5/20/ipo-access-is-here

- Cyber

- Executive Order on Cybersecurity Expands Mandatory Breach Notification https://trtl.bz/3uhzCUm

- Cybersecurity After COVID-19: 10 Ways to Protect (Marsh) https://trtl.bz/3ffPVwV Risk Resilience Report (pdf here). Marsh's Ransomware (Remove Response Paralysis with a Comprehensive Incident Response Plan) https://trtl.bz/34cKtnX

- So You Want to Be a Cyber Risk Analyst https://trtl.bz/2QIdXqG mentions GARP

- Data

- Handbook of Regression Modeling in People Analytics by Keith McNulty http://peopleanalytics-regression-book.org/index.html

- Introduction: Building the AI bank of the future (McKinsey) https://trtl.bz/2RKEQLh

- How I’m Overcoming My Fear of Math to Learn Data Science https://trtl.bz/2Tfu3cp

- Machine Learning and the Coming Transformation of Finance https://trtl.bz/3yJmUS3

- Climate/ESG

- Executive Order on Climate-Related Financial Risk https://trtl.bz/3yz3D5t

- AXA XL and Climate Risk: Protecting What Matters (new website) https://axaxl.com/climate-risk

- Other

- Two arguments against the mean: The Danger of Making Decisions based upon Averages https://trtl.bz/2SgiFwm; Strategists: Stop Obsessing about Averages https://trtl.bz/34eSite

- What’s the Secret to Making a Great Prediction? (freakonomics.com) https://freakonomics.com/podcast/nsq-predictions/

- The High Cost of Noise in Decision Making (Barry Ritholtz interviews Daniel Kahneman) https://trtl.bz/3wwgvrq

Last edited by a moderator: