gargi.adhikari

Active Member

In reference to R27.P1.T4.Hull_Ch13_15_19:Topic: BLACK-SCHOLES-MERTON_MODEL :-

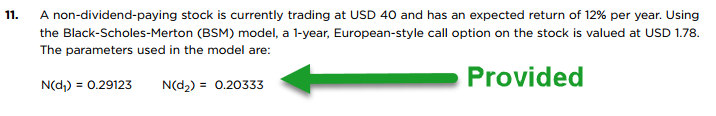

In the exam, if we were to calculate the Call or Put Option prices using the BSM Model, would it be safe to assume that N(d1) & N(d2) would ALWAYS be provided given....?

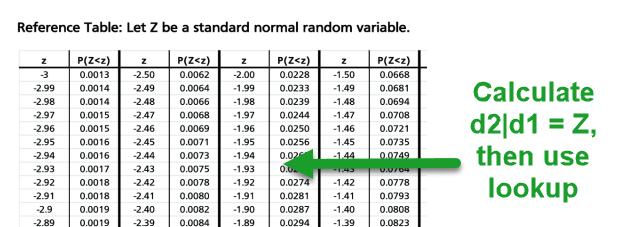

There are formulae to calculate the d1 and d2 but not sure how we would deduce the N(d1) & N(d2) knowing the d1 & d2 in the exam...

Thanks much for any insights on this.

In the exam, if we were to calculate the Call or Put Option prices using the BSM Model, would it be safe to assume that N(d1) & N(d2) would ALWAYS be provided given....?

There are formulae to calculate the d1 and d2 but not sure how we would deduce the N(d1) & N(d2) knowing the d1 & d2 in the exam...

Thanks much for any insights on this.