Hi David,

for practice exam Q64, would the exam specify the shape of the smile? (e.g. heavy lift tail, lighter right tail). Or are we suppose to know the shape? if yes, could you please advise what's the correct shape of the volatility smile for each type of options? thank you!

64. A committee of risk management practitioners discusses the difference between pricing deep out-of-the-money call options on FBX stock and pricing deep out-of-the-money call options on the EUR/JPY foreign exchange rate using the Black-Scholes-Merton (BSM) model. The practitioners price these options based on two distinct probability distributions of underlying asset prices at the option expiration date:

a. Price the option on FBX relatively high and price the option on EUR/JPY relatively low.

b. Price the option on FBX relatively low and price the option on EUR/JPY relatively high.

c. Price the option on FBX relatively low and price the option on EUR/JPY relatively low.

d. Price the option on FBX relatively high and price the option on EUR/JPY relatively high.

for practice exam Q64, would the exam specify the shape of the smile? (e.g. heavy lift tail, lighter right tail). Or are we suppose to know the shape? if yes, could you please advise what's the correct shape of the volatility smile for each type of options? thank you!

64. A committee of risk management practitioners discusses the difference between pricing deep out-of-the-money call options on FBX stock and pricing deep out-of-the-money call options on the EUR/JPY foreign exchange rate using the Black-Scholes-Merton (BSM) model. The practitioners price these options based on two distinct probability distributions of underlying asset prices at the option expiration date:

- A lognormal probability distribution

- An implied risk-neutral probability distribution obtained from the volatility smile for options of the same maturity

a. Price the option on FBX relatively high and price the option on EUR/JPY relatively low.

b. Price the option on FBX relatively low and price the option on EUR/JPY relatively high.

c. Price the option on FBX relatively low and price the option on EUR/JPY relatively low.

d. Price the option on FBX relatively high and price the option on EUR/JPY relatively high.

Last edited by a moderator:

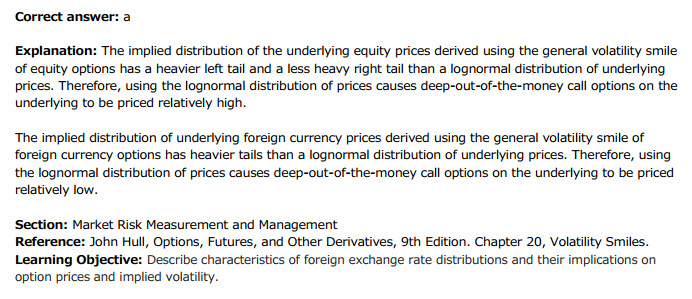

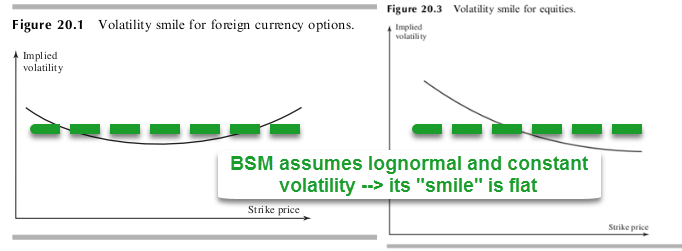

) . We should actually be comparing the right-hand side of the charts. On the right-hand side, you can see they do not have the same shape. I just edited to read the following, please let me know if this doesn't settle it:

) . We should actually be comparing the right-hand side of the charts. On the right-hand side, you can see they do not have the same shape. I just edited to read the following, please let me know if this doesn't settle it: