ravishankar80

New Member

Hi David,

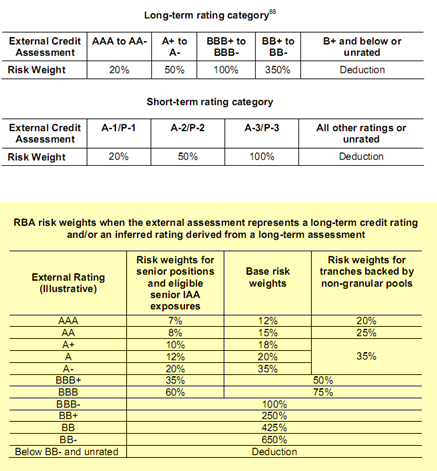

Wanted to clarify on treatment of securitization exposures under BASEL II. I am not very clear on the difference between the Standardized approach and the IRB approach which uses RBA-Ratings Based Approach. Both seem to use credit ratings and apply the risk weights accordingly. So where is the difference ? Thanks in advance

Ravi

Wanted to clarify on treatment of securitization exposures under BASEL II. I am not very clear on the difference between the Standardized approach and the IRB approach which uses RBA-Ratings Based Approach. Both seem to use credit ratings and apply the risk weights accordingly. So where is the difference ? Thanks in advance

Ravi