Swarnendu Pathak

New Member

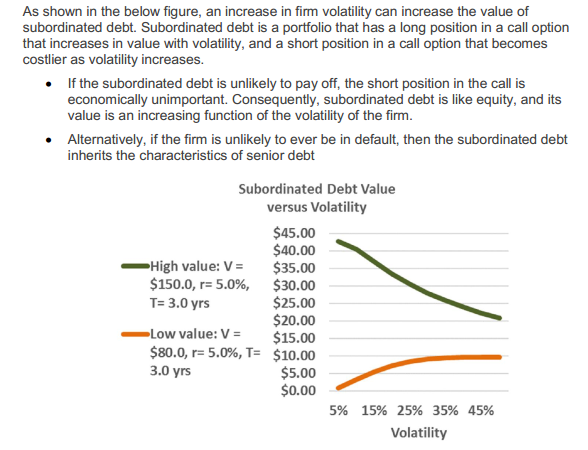

Can anybody please explain why the value of the subordinate debt will increase & value of senior debt will decrease when the firm is under financial distress? It is explained that under the financial distress the subordinate debts will act like equity but please highlight on how the value of the same would increase.

Thanks in advance.

Thanks in advance.