Hi David,

Long time no see! How are you doing!

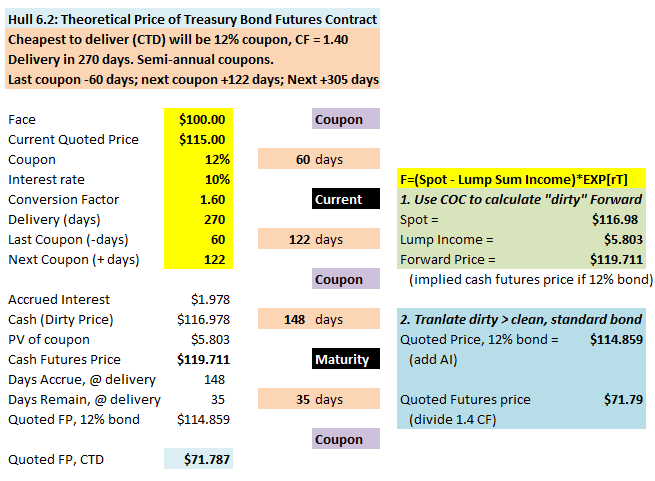

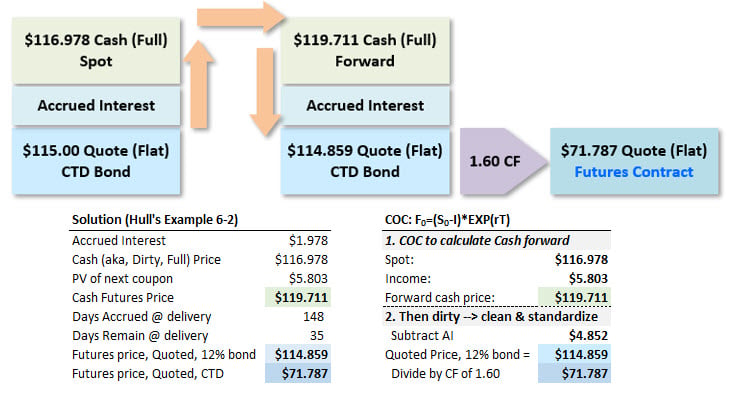

I have a question about this topic, which is in Hull's Chapter 6.2, Edition 7, and also a topic in FRM part1. In Hull's book, first, he calculated the dirty price by adding quoted bond price and accrued interest rate. Then, using F0=(S0-I)e^rT. After that, F0 was subtracted by another accrued interest rate, and then divided by conversion factor. Is this the quoted future price that theoretically we should get from the exchange or broker based on the assumption that it was the cheapest to deliver and known delivery date? Could you please explain why the calculation should be like that?

Thanks a lot for your time!

Long time no see! How are you doing!

I have a question about this topic, which is in Hull's Chapter 6.2, Edition 7, and also a topic in FRM part1. In Hull's book, first, he calculated the dirty price by adding quoted bond price and accrued interest rate. Then, using F0=(S0-I)e^rT. After that, F0 was subtracted by another accrued interest rate, and then divided by conversion factor. Is this the quoted future price that theoretically we should get from the exchange or broker based on the assumption that it was the cheapest to deliver and known delivery date? Could you please explain why the calculation should be like that?

Thanks a lot for your time!