You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Effect of time to maturity on sub bonds

- Thread starter irwinchung

- Start date

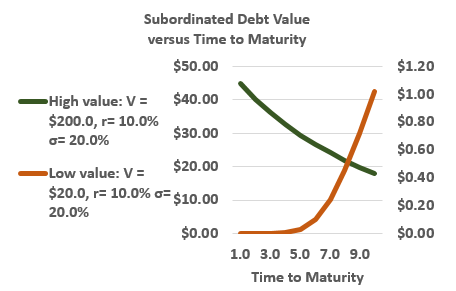

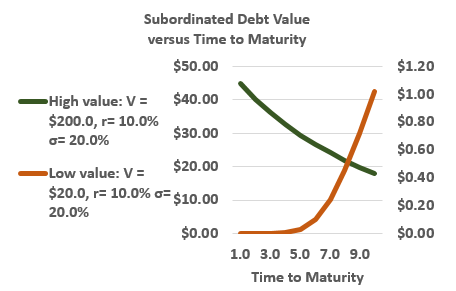

Hi @irwinchung Yes, I think yours is a great simplifying frame. Two key drivers of the subordinated debt value are "optionality" (or I might say "net volatility effect") and the present value effect of discounting debt. The "optionality" is subtle/complex because in the model subordinated debt = [call option on firm's assets with K = senior debt] - [call option on firm assets K = total debt; aka, equity value] such that both options increase with maturity and volatility. In my example (above), from years 1 to 4 the first option (K = senior debt) is growing faster than the second then at year 5 the value of the second equity option (K = total debt) grows faster. Volatility is on both sides of the fence here  That's why, if I had to reduce the dynamic to a single trade-off, i might call it something like "net volatility" versus your "present value" or discounting effect.

That's why, if I had to reduce the dynamic to a single trade-off, i might call it something like "net volatility" versus your "present value" or discounting effect.

In case it's interesting, here is my XLS for this https://www.dropbox.com/s/k8i579drg4gerlv/0415-stulz-subordinated.xlsx?dl=0

... mine doesn't exactly use Stulz assumptions (because i didn't want to present two vertical axes. Below is Stulz's assumptions where he assumes asset value = $20 (versus my $100 above). Note the scale. His assumption of V = $20, F (senior) = $100 and D (subord) = $50 of course has the subordinated debt deeply out-of-the-money such that, starting from zero, the "optionality" or "net volatility" effect is driving all of the increase, which is small in dollar terms (at 10 years, it's only 1.02 million). I hope that's interesting!

That's why, if I had to reduce the dynamic to a single trade-off, i might call it something like "net volatility" versus your "present value" or discounting effect.

That's why, if I had to reduce the dynamic to a single trade-off, i might call it something like "net volatility" versus your "present value" or discounting effect.In case it's interesting, here is my XLS for this https://www.dropbox.com/s/k8i579drg4gerlv/0415-stulz-subordinated.xlsx?dl=0

... mine doesn't exactly use Stulz assumptions (because i didn't want to present two vertical axes. Below is Stulz's assumptions where he assumes asset value = $20 (versus my $100 above). Note the scale. His assumption of V = $20, F (senior) = $100 and D (subord) = $50 of course has the subordinated debt deeply out-of-the-money such that, starting from zero, the "optionality" or "net volatility" effect is driving all of the increase, which is small in dollar terms (at 10 years, it's only 1.02 million). I hope that's interesting!

Hello, I have been reading up on the chapter about senior debt and subordinated date valuation and I saw some in the text "Senior debt always falls in value when firm volatility increases" or "As the interest rate rises, the value of senior debt falls", which does not really offer much explanation.

I kinda understand them through the formula. But I am wondering if there is a more intuitive way to understand the relationships?

Thanks.

I kinda understand them through the formula. But I am wondering if there is a more intuitive way to understand the relationships?

Thanks.

Hi @silver7 I moved your query to this thread, see above, let me know if this helps? Thanks!

Hi David,

While studying the aforesaid chapter on Credit Risk and Derivatives, I am struggling to understand the following line with regards to valuing a senior debt.

For some reason I find this statement a bit counter-intuitive. If the firm's volatility increases, then wouldn't the firm's ability to pay off the subordinated debt weaken ? Since in times of high volatility for a distressed firm I understand that it would be difficult for the firm to pay off the obligations towards the Senior Debt leave alone Subordinated Debt. In such a case shouldn't the value decrease ? Also, if the volatility increases, the Credit Spreads would also increase thus reducing the Value of Debt (due to inverse relationship between price and yield).

I believe I might be missing something, and I apologize if it is a simplistic error.

Thanks.

While studying the aforesaid chapter on Credit Risk and Derivatives, I am struggling to understand the following line with regards to valuing a senior debt.

"Consequently, when a firm is in poor financial condition, subordinated debt is unlikely to be paid in full and is more like an equity claim than a debt claim. In this case, an increase in firm volatility makes it more likely that subordinated debt will be paid off and increases the value of subordinated debt. Senior debt always falls in value when firm volatility increases."

For some reason I find this statement a bit counter-intuitive. If the firm's volatility increases, then wouldn't the firm's ability to pay off the subordinated debt weaken ? Since in times of high volatility for a distressed firm I understand that it would be difficult for the firm to pay off the obligations towards the Senior Debt leave alone Subordinated Debt. In such a case shouldn't the value decrease ? Also, if the volatility increases, the Credit Spreads would also increase thus reducing the Value of Debt (due to inverse relationship between price and yield).

I believe I might be missing something, and I apologize if it is a simplistic error.

Thanks.

@ABSMOGHEHi David,

While studying the aforesaid chapter on Credit Risk and Derivatives, I am struggling to understand the following line with regards to valuing a senior debt.

For some reason I find this statement a bit counter-intuitive. If the firm's volatility increases, then wouldn't the firm's ability to pay off the subordinated debt weaken ? Since in times of high volatility for a distressed firm I understand that it would be difficult for the firm to pay off the obligations towards the Senior Debt leave alone Subordinated Debt. In such a case shouldn't the value decrease ? Also, if the volatility increases, the Credit Spreads would also increase thus reducing the Value of Debt (due to inverse relationship between price and yield).

I believe I might be missing something, and I apologize if it is a simplistic error.

Thanks.

I did a search in the forum, and I believe that this thread should help to answer your question. I'm sure there are many more threads in the forum regarding senior debt (many threads came up in my search), but this one should help a bit.

Thank you,

Nicole

@Nicole Seaman. Thanks. This clarified the issue.

@ABSMOGHE we also use tags, you might notice at the topic is a tag for "subordinated" (https://forum.bionicturtle.com/tags/subordinated/) which would lead to this thread. We need to ask you to make an attempt to search before posting to a fresh thread (you posted three times this morning to entirely new threads. We are less than a month before the exam, it's not good manners to "carpet bomb" the forum), please try to respect our time. Thank you,

@David Harper CFA FRM I sincerely apologize for it. I was unaware about this feature. Will keep in mind to use this before posting the next time. However just to be fair, 2 of the posts were made 2 days ago and not as of this morning. However I will definitely keep in mind the next time I post to use the tagging function first, as I definitely do respect your time and efforts.

Also, with regards to this post here https://forum.bionicturtle.com/threads/collateral-calculation-of-credit-support-amount.21723/

I tried searching for Collateral and Credit Support Amount, however there were no corresponding links addressing my query. Do let me know if any other search tags could lead me to my answer.

Thanks.

Also, with regards to this post here https://forum.bionicturtle.com/threads/collateral-calculation-of-credit-support-amount.21723/

I tried searching for Collateral and Credit Support Amount, however there were no corresponding links addressing my query. Do let me know if any other search tags could lead me to my answer.

Thanks.

Hi @ABSMOGHE Oh okay, sorry, they came up today freshly for me, for some reason (3 new posts); Nicole was trying to help with them, maybe they were moved. This forum is becoming very time-consuming for me personally (and somewhat brutal on my spare time), and I am starting to wonder if the economics are justified. I appreciate you good intentions. Thank you!

Hi @Jose V I moved your question to this thread where I previously shared the XLS, please see above (protip: it has a tag = "subordinated"). Thanks,

Hi Nicole, I have the same question as @ABSMOGHE but in your reply, I dont see the link. Please let me know what I am missing.@ABSMOGHE

I did a search in the forum, and I believe that this thread should help to answer your question. I'm sure there are many more threads in the forum regarding senior debt (many threads came up in my search), but this one should help a bit.

Thank you,

Nicole

Hi David, I am puzzled by the following lines

"Consequently, when a firm is in poor financial condition, subordinated debt is unlikely to be paid in full and is more like an equity claim than a debt claim. In this case, an increase in firm volatility makes it more likely that subordinated debt will be paid off and increases the value of subordinated debt. Senior debt always falls in value when firm volatility increases."

If a firm volatility increase the call value, then isn't the call option likely to be ITM at expiration ? If thats the case, why do we use subordinated debt or any equity-like claim is unlikely to be paid ?

Appreciate your help in clarifying. Thank you

"Consequently, when a firm is in poor financial condition, subordinated debt is unlikely to be paid in full and is more like an equity claim than a debt claim. In this case, an increase in firm volatility makes it more likely that subordinated debt will be paid off and increases the value of subordinated debt. Senior debt always falls in value when firm volatility increases."

If a firm volatility increase the call value, then isn't the call option likely to be ITM at expiration ? If thats the case, why do we use subordinated debt or any equity-like claim is unlikely to be paid ?

Appreciate your help in clarifying. Thank you

Hello @nansvermaHi Nicole, I have the same question as @ABSMOGHE but in your reply, I dont see the link. Please let me know what I am missing.

You aren't missing anything

There was no link provided because I had moved ABSMOGHE's post to this thread. That member had posted elsewhere in the forum and I moved it here to help answer their question.

There was no link provided because I had moved ABSMOGHE's post to this thread. That member had posted elsewhere in the forum and I moved it here to help answer their question. Nicole

Thanks Nicole.

I am puzzled by stulz chapter so I have more dumb questions perhaps. When we say debt or equity increases or decreases in value with volatility, intererst rate etc..are we assuming rest everything remains same ? Suppose there is no subordinate debt, only senior debt and equity. When interest rates rise, i have read stocks price fall down. But in this chapter, equity increases with interest rate rise. Does equity increases only because debt decreases or there are other factors ? Seems contradicting . Please help.

I am puzzled by stulz chapter so I have more dumb questions perhaps. When we say debt or equity increases or decreases in value with volatility, intererst rate etc..are we assuming rest everything remains same ? Suppose there is no subordinate debt, only senior debt and equity. When interest rates rise, i have read stocks price fall down. But in this chapter, equity increases with interest rate rise. Does equity increases only because debt decreases or there are other factors ? Seems contradicting . Please help.

Hi @nansverma Yes, I think you are right to be puzzled by Stulz: we've had to contend with contradictions surfaced in Chapter 18 for a decade; e.g, see https://forum.bionicturtle.com/threads/interest-rates-stultz.10689/post-52227 There are a few problems, but in my opinion, your point speaks to the difference between his theoretical-model approach and his empirical statements (compounded by writing that is notoriously difficult to decipher). The fundamental idea of his his credit risk chapter is option-pricing-model-based and therefore purely theoretical. The theory includes that equity is a call option on the firm's assets and, under this pure model, an increase in the interest rate implies an increase in equity value (i.e., an increase in the riskfree rate increases the value of an option).

However, he also says that "empirical evidence suggests that stock prices are negatively correlated with interest rates." And, as an equity investor, I can tell you this tends to be true a lot! (in just the last two months, equity prices have been greatly influenced by the Fed's statements about possible rate hikes). This empirical evidence is based in a simple idea: higher interest rates imply a higher discount rate on future earnings/cash flows and therefore a lower present value of the equity claim. Further, in Stulz option-based approach, a higher rate of course lowers the present value of debt, such that, given a certain firm value, lower debt will increase the residual equity claim! I simply do not see Stulz reconcile these two approaches. I can try to say (and I have said) that it's a case of theoretical-model (i.e., BSM) versus empirical observation, but the slight problem there is that, you can see, he also employs models that can contradict with respect to interest rate interactions. I hope that's helpful, thanks!

However, he also says that "empirical evidence suggests that stock prices are negatively correlated with interest rates." And, as an equity investor, I can tell you this tends to be true a lot! (in just the last two months, equity prices have been greatly influenced by the Fed's statements about possible rate hikes). This empirical evidence is based in a simple idea: higher interest rates imply a higher discount rate on future earnings/cash flows and therefore a lower present value of the equity claim. Further, in Stulz option-based approach, a higher rate of course lowers the present value of debt, such that, given a certain firm value, lower debt will increase the residual equity claim! I simply do not see Stulz reconcile these two approaches. I can try to say (and I have said) that it's a case of theoretical-model (i.e., BSM) versus empirical observation, but the slight problem there is that, you can see, he also employs models that can contradict with respect to interest rate interactions. I hope that's helpful, thanks!

Similar threads

- Replies

- 1

- Views

- 416

- Replies

- 0

- Views

- 780

- Replies

- 1

- Views

- 1K

- Replies

- 0

- Views

- 2K