Head on over to our Facebook page to enter our Trivia Contest! You will be entered to win a $15 gift card of your choice from Starbucks, Amazon or iTunes (iTunes is US only)!

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

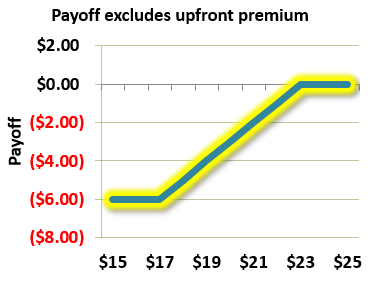

OPTION TRADE DIAGRAMS

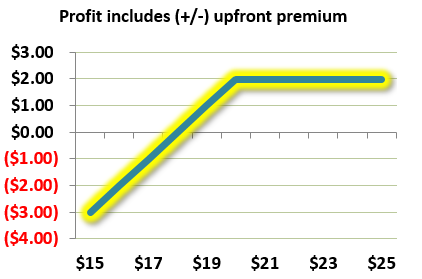

Question 1:

A. Short call

B. Long Put

C. Write covered call (long stock + short call)

D. Buy protective put (long stock + long put)

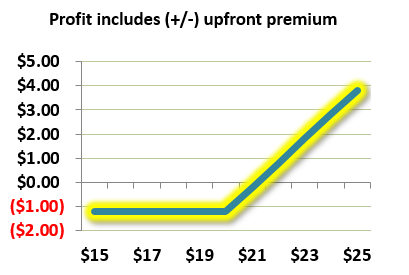

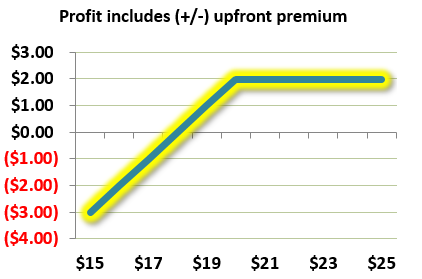

Question 2:

A. Short call

B. Long Put

C. Write covered call (long stock + short call)

D. Buy protective put (long stock + long put)

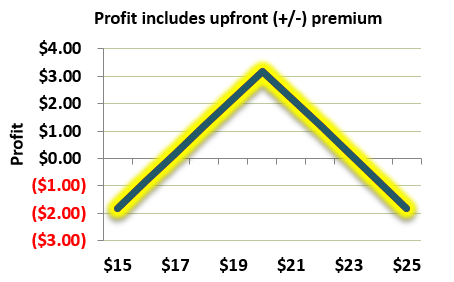

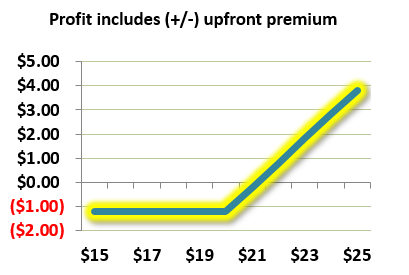

Question 3:

A. Straddle write

B. Straddle purchase

C. Bull spread with calls

D. Bear spread with puts

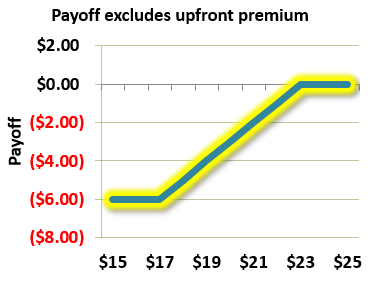

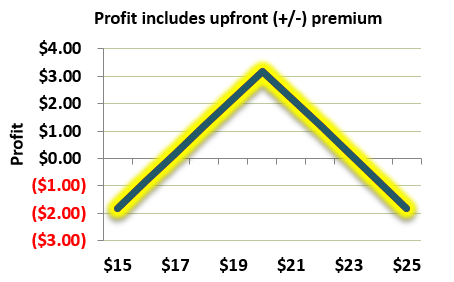

Question 4:

A. Straddle purchase

B. Bull spread with calls

C. Bull spread with puts

D. Bear spread

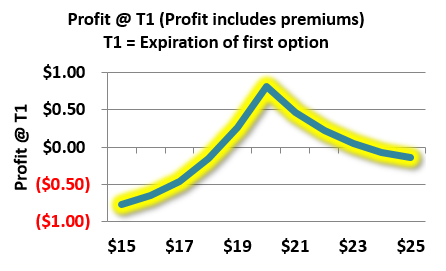

Question 5:

A. Butterfly spread

B. Calendar spread

C. Strip and strap

D. Box spread

If you do not have Facebook, you can enter right here in our forum. Just answer the following questions:

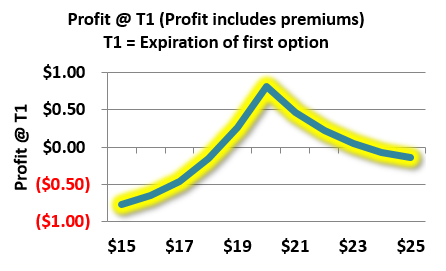

OPTION TRADE DIAGRAMS

Question 1:

A. Short call

B. Long Put

C. Write covered call (long stock + short call)

D. Buy protective put (long stock + long put)

Question 2:

A. Short call

B. Long Put

C. Write covered call (long stock + short call)

D. Buy protective put (long stock + long put)

Question 3:

A. Straddle write

B. Straddle purchase

C. Bull spread with calls

D. Bear spread with puts

Question 4:

A. Straddle purchase

B. Bull spread with calls

C. Bull spread with puts

D. Bear spread

Question 5:

A. Butterfly spread

B. Calendar spread

C. Strip and strap

D. Box spread

Last edited by a moderator: