cbrach

New Member

Hi @David Harper CFA FRM

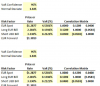

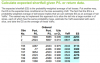

In the formula sheet page 21, it looks like expected shortfall column is incorrect. It appears to be dividing by (n - 1) losses in excess of the VaR instead of n.

Updated by Nicole to add image of formula sheet being referenced

In the formula sheet page 21, it looks like expected shortfall column is incorrect. It appears to be dividing by (n - 1) losses in excess of the VaR instead of n.

Updated by Nicole to add image of formula sheet being referenced

Last edited by a moderator: