You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Exogenous Liquidity vs. Endogenous Liquidity

- Thread starter MSharky

- Start date

jairamjana

Member

I will direct to one of BT notes in investopedia.. The last para summarises it

http://www.investopedia.com/articles/trading/11/understanding-liquidity-risk.asp

Hope that's useful..

http://www.investopedia.com/articles/trading/11/understanding-liquidity-risk.asp

Hope that's useful..

Hi,

Also see: https://forum.bionicturtle.com/thre...g-endogenous-liquidity-risks.5463/#post-15316

Thanks

Also see: https://forum.bionicturtle.com/thre...g-endogenous-liquidity-risks.5463/#post-15316

Thanks

frmpart2dan

Member

Could someone explains and give some examples on these types of liquidity risk? I am not clear from reading the notes on the difference between the two. Thanks

Hi @frmpart2dan

Here is an incredibly extreme and public case of endogenous liquidity risk http://www.bloomberg.com/news/artic...-risks-becoming-too-big-to-exit-lawmaker-says

i.e., "Owning 63 percent means when it’s time to exit, selling such huge amounts would result in ETFs diverging from their theoretical prices"

Endogenous price risk is when your position is such that the act of selling puts downward pressure on the price, as opposed to most retail stock trades (where selling a few doesn't change the price). Another (sort of, arguable) example would be a homeowner under time pressure to sell their house. The homeowner might have the house appraised at $250,000 and that might be its fair market value, but if the owner wants to sell immediately, she may need to bring the price down (the selling price is a function of the selling action). But the classic example is a prominent fund manager or "whale" with such a meaningful position that he/she has difficulty unwinding it without sending prices down.

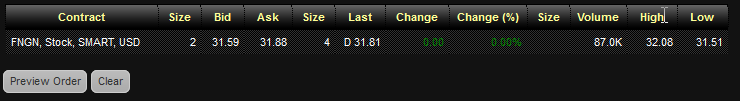

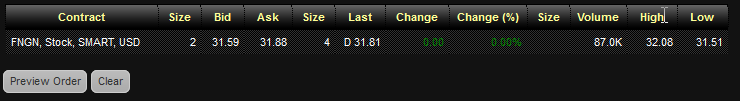

With respect to exogenous liquidity, that is when the sales price is independent of the act of selling. Bid-ask spreads are the common measure and a good example. I just pulled up a quote for Financial Engines, a barely small cap publiCo (https://finance.yahoo.com/quote/FNGN). The bid is 31.59 and the ask is 31.88, so the spread is 0.91%. Larger, more liquid stocks should have a smaller spread; i.e., less exogenous liquidity risk. I hope these examples are helpful.

Here is (highly selective by me) Dowd:

Here is an incredibly extreme and public case of endogenous liquidity risk http://www.bloomberg.com/news/artic...-risks-becoming-too-big-to-exit-lawmaker-says

i.e., "Owning 63 percent means when it’s time to exit, selling such huge amounts would result in ETFs diverging from their theoretical prices"

Endogenous price risk is when your position is such that the act of selling puts downward pressure on the price, as opposed to most retail stock trades (where selling a few doesn't change the price). Another (sort of, arguable) example would be a homeowner under time pressure to sell their house. The homeowner might have the house appraised at $250,000 and that might be its fair market value, but if the owner wants to sell immediately, she may need to bring the price down (the selling price is a function of the selling action). But the classic example is a prominent fund manager or "whale" with such a meaningful position that he/she has difficulty unwinding it without sending prices down.

With respect to exogenous liquidity, that is when the sales price is independent of the act of selling. Bid-ask spreads are the common measure and a good example. I just pulled up a quote for Financial Engines, a barely small cap publiCo (https://finance.yahoo.com/quote/FNGN). The bid is 31.59 and the ask is 31.88, so the spread is 0.91%. Larger, more liquid stocks should have a smaller spread; i.e., less exogenous liquidity risk. I hope these examples are helpful.

Here is (highly selective by me) Dowd:

"14.2.2. The Exogenous Spread Approach: If our position is ‘small’ relative to the size of the market (e.g., because we are a very small player in a very large market), then our trading should have a negligible impact on the market price. In such circumstances we can regard the bid–ask spread as exogenous to us, and we can assume that the spread is determined by the market beyond our control. However, if our position is large relative to the market, our activities will have a noticeable effect on the market itself, and can affect both the ‘market’ price and the bid–ask spread. For example, if we suddenly unload a large position, we should expect the ‘market’ price to fall and the bid–ask spread to widen. In these circumstances the ‘market’ price and the bid–ask spread are to some extent endogenous (i.e., responsive to our trading activities) and we should take account of how the market might react to us when estimating liquidity costs and risks. Other things again being equal, the bigger our trade, the bigger the impact we should expect it to have on market prices.

... If our position is sufficiently small relative to the market, we can regard our spread risk as exogenous to us (i.e., independent of our own trading),

....

14.2.3 Endogenous-price Approaches

The previous approaches assume that prices are exogenous and therefore ignore the possibility of the market price responding to our trading. However, this is often unreasonable, and we may wish to make a liquidity adjustment that reflects the response of the market to our trading. If we sell, and the act of selling reduces the price, then this market-price response creates an additional loss relative to the case where the market price is exogenous, and we need to add this extra loss to our VaR. The liquidity adjustment will also depend on the responsiveness of market prices to our trade: the more responsive the market price, the bigger the loss."

Last edited:

saurabhpal49

New Member

Hi David

In BT notes it's mentioned that endogenous liquidity risk are important when

* The market for the underlying of the derivative is subject to asymmetric information, which magnifies the sensivity of prices to clusters of similar trades

Could you please explain this point

In BT notes it's mentioned that endogenous liquidity risk are important when

* The market for the underlying of the derivative is subject to asymmetric information, which magnifies the sensivity of prices to clusters of similar trades

Could you please explain this point

Hi there @saurabhpal49

As you might be aware, one of the components of the measurement of Liquidity Risk is based on the impact of our trade on the security price. Hence, whenever our trade cannot be expected to have an impact on the security price, exogenous measures are used. However, this can be true only if we are a small player/size of our trade is small

However, this is rarely the case and with the advent of High Frequency Trading, we can see that any trade is perceived as an harbinger of information and the market responds negatively to, say our short trades, reducing our spread margins on any subsequent shorts. This forces us to add an extra measure of Endogenous Liquidity Risk to our Liquidity Risk measure. This effect is compounded in cases of "Assymetric Information" where one party can be expected to have more information than the counterparty.

I can give you two examples

1. Take what happened to the market for CDS on Sub Prime Mortgages; when the seller of the protection(AIG) initially entered into the contract, it was not aware that the product for which it was writing protection was a bomb waiting to explode and hence the CDS was for a cheaper premium, however, once the true nature of the MBS was revealed, the market for the CDS froze with premiums going sky high with more and more players wanting to buy the same for the troubled assets on their Balance sheets or Portfolios

2. Which takes us to the MBS itself, when they were initially traded there was a liquid market for it and when some of the players got wind of the fact (before others) that the underlying of the MBS (viz. the home mortgages) was defaulting at an alarming rate and started to offload the same, it was followed by a selling spree as a result of the market realizing that something was amiss and the prices tanked at an alarming rate. This is a classic case of asymmetric information and the huge spike in volatility and the increase in price sensitivity due to frenzy selling.

Hope this helped

Thanks

As you might be aware, one of the components of the measurement of Liquidity Risk is based on the impact of our trade on the security price. Hence, whenever our trade cannot be expected to have an impact on the security price, exogenous measures are used. However, this can be true only if we are a small player/size of our trade is small

However, this is rarely the case and with the advent of High Frequency Trading, we can see that any trade is perceived as an harbinger of information and the market responds negatively to, say our short trades, reducing our spread margins on any subsequent shorts. This forces us to add an extra measure of Endogenous Liquidity Risk to our Liquidity Risk measure. This effect is compounded in cases of "Assymetric Information" where one party can be expected to have more information than the counterparty.

I can give you two examples

1. Take what happened to the market for CDS on Sub Prime Mortgages; when the seller of the protection(AIG) initially entered into the contract, it was not aware that the product for which it was writing protection was a bomb waiting to explode and hence the CDS was for a cheaper premium, however, once the true nature of the MBS was revealed, the market for the CDS froze with premiums going sky high with more and more players wanting to buy the same for the troubled assets on their Balance sheets or Portfolios

2. Which takes us to the MBS itself, when they were initially traded there was a liquid market for it and when some of the players got wind of the fact (before others) that the underlying of the MBS (viz. the home mortgages) was defaulting at an alarming rate and started to offload the same, it was followed by a selling spree as a result of the market realizing that something was amiss and the prices tanked at an alarming rate. This is a classic case of asymmetric information and the huge spike in volatility and the increase in price sensitivity due to frenzy selling.

Hope this helped

Thanks

saurabhpal49

New Member

Hi there @saurabhpal49

As you might be aware, one of the components of the measurement of Liquidity Risk is based on the impact of our trade on the security price. Hence, whenever our trade cannot be expected to have an impact on the security price, exogenous measures are used. However, this can be true only if we are a small player/size of our trade is small

However, this is rarely the case and with the advent of High Frequency Trading, we can see that any trade is perceived as an harbinger of information and the market responds negatively to, say our short trades, reducing our spread margins on any subsequent shorts. This forces us to add an extra measure of Endogenous Liquidity Risk to our Liquidity Risk measure. This effect is compounded in cases of "Assymetric Information" where one party can be expected to have more information than the counterparty.

I can give you two examples

1. Take what happened to the market for CDS on Sub Prime Mortgages; when the seller of the protection(AIG) initially entered into the contract, it was not aware that the product for which it was writing protection was a bomb waiting to explode and hence the CDS was for a cheaper premium, however, once the true nature of the MBS was revealed, the market for the CDS froze with premiums going sky high with more and more players wanting to buy the same for the troubled assets on their Balance sheets or Portfolios

2. Which takes us to the MBS itself, when they were initially traded there was a liquid market for it and when some of the players got wind of the fact (before others) that the underlying of the MBS (viz. the home mortgages) was defaulting at an alarming rate and started to offload the same, it was followed by a selling spree as a result of the market realizing that something was amiss and the prices tanked at an alarming rate. This is a classic case of asymmetric information and the huge spike in volatility and the increase in price sensitivity due to frenzy selling.

Hope this helped

Thanks

It really helped

Thanks

Hi there @saurabhpal49

I recommend you watch the movie, "The Margin Call". It is worth it and this situation plays out at the wee end.

Thanks

I recommend you watch the movie, "The Margin Call". It is worth it and this situation plays out at the wee end.

Thanks

Similar threads

- Replies

- 0

- Views

- 117

- Replies

- 0

- Views

- 103

- Replies

- 0

- Views

- 122

- Replies

- 0

- Views

- 291