Hi David/All,

This may be a trivial question..but a bit not clear to me .When going through the Wrong Way risk where Conditional EE is discussed..

Question 1)

Expected Exposure in General terms=Avg ( +ve MTM ) counter party owes to the bank

If we take an IR Swap example the above Unconditional EE should be same when we have IRS contract with two counterparties of varying credit quality given the initial terms (Fixed/Floating) same?

The Counterparty Risk ( ~ EE * PD*LGD) will be high with lower grade counterparty .

Please confirm

Question 2)

When we say Conditional EE .In the above IRS example the EE going to be same (depending on systematic factors like Interest Rates/FX ..) ? How does the EE vary between counter parties?Are we referring the initial terms of contract (Fixed/Floating) will be different based on the Credit grade of counter party and hence the conditional EE changes

Thanks

Biju

This may be a trivial question..but a bit not clear to me .When going through the Wrong Way risk where Conditional EE is discussed..

Question 1)

Expected Exposure in General terms=Avg ( +ve MTM ) counter party owes to the bank

If we take an IR Swap example the above Unconditional EE should be same when we have IRS contract with two counterparties of varying credit quality given the initial terms (Fixed/Floating) same?

The Counterparty Risk ( ~ EE * PD*LGD) will be high with lower grade counterparty .

Please confirm

Question 2)

When we say Conditional EE .In the above IRS example the EE going to be same (depending on systematic factors like Interest Rates/FX ..) ? How does the EE vary between counter parties?Are we referring the initial terms of contract (Fixed/Floating) will be different based on the Credit grade of counter party and hence the conditional EE changes

Thanks

Biju

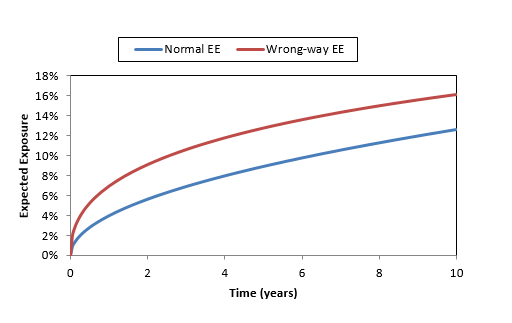

...or it could always be that I am just missing something in my reading. (I also can't tell if you are referring to statements in our notes, questions or Gregory's source). I would start by taking a step back to basic terms here. Below is Gregory's chart from his spreadsheet 15.1 (wrong way risk) which is similar to his Fig 15.1 (XLS here at

...or it could always be that I am just missing something in my reading. (I also can't tell if you are referring to statements in our notes, questions or Gregory's source). I would start by taking a step back to basic terms here. Below is Gregory's chart from his spreadsheet 15.1 (wrong way risk) which is similar to his Fig 15.1 (XLS here at