Kavita.bhangdia

Active Member

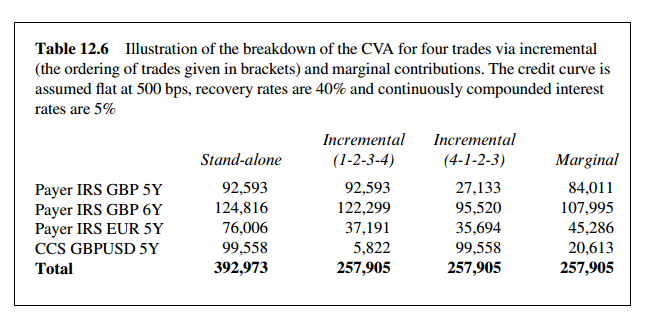

David mentions in one of the problems that marginal CVA is greater than incremental CVA.

Why it is so.. I thought that incremental CVA will be large because you are adding an entire trade for CVAcalculation whereas marginal CVA is just a partial derivative..

Please clarify..

Thanks

Kavita

Why it is so.. I thought that incremental CVA will be large because you are adding an entire trade for CVAcalculation whereas marginal CVA is just a partial derivative..

Please clarify..

Thanks

Kavita