Since we get a lot of questions on Merton (some issues are merely notational), I wanted to collect my observations into a single place. I hope you like. (fwiw, I don't endorse it, I blame the prominence of this on Stulz' influence in the FRM  ... the math of the BSM is admittedly seductive.)

... the math of the BSM is admittedly seductive.)

The Merton model for credit risk has two steps:

The Black-Scholes OPM solves for a European call option = S(0)*N(d1) - K*exp(-rT)*N(d2).

Step 1 (derivatives valuation): price firm equity like a call option: The first step above employs the BSM OPM precisely because its central insight is to treat the firm's equity as a call option on the firm's assets. In this way:

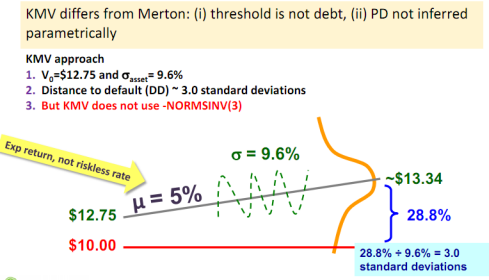

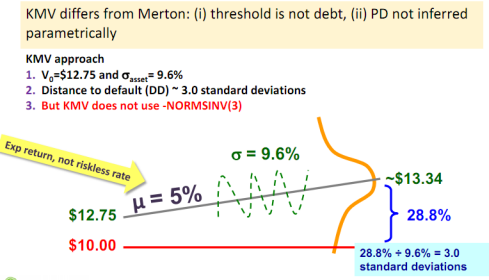

An FRM P2 candidate should try understand the relatively simple intuition of this step, which is not option pricing, it is just statistics. See image below (page 15, from video 6c). I am using de Servigny's numbers.

From left-to-right:

The more typical approach, above, derives a standard normal Z deviate by assuming log returns are normally distributed: if LN(S2/S1) is normal then S2 is lognormal. As such, the more typical distance-to-default above produced a standardized normal return-based DD of 3.0 = 28.8% continuous return / 9.6% per annum volatility. In BSM, the numerator of d2 is a continuous return, standardized by dividing by the annualized volatility in the denominator, to give a unitless standard normal deviate.

Alternatively, the distance of default can be expressed as a function of the dollar difference between the future firm asset value and the threshold, in this case: $13.34 - $10 = $3.34. And then standardize that by dividing by the volatility to get the alternative distance to default:

With respect to the exam (I can't judge the testability of any of this, GARP has been uneven here, overall testability may well be low):

The two steps above illustrate the Merton as (i) assuming the firm will default upon insolvency, asset(t) < face value of all debt(t) and (ii) inferring the area in insolvency tail as a function of a normal return (lognormal price) asset distribution. The KMV method, who I consulted to years ago, recognizes and addresses these two unrealistic assumption.

... the math of the BSM is admittedly seductive.)

... the math of the BSM is admittedly seductive.)The Merton model for credit risk has two steps:

- Use the Black-Scholes-Merton option-pricing model (BSM OPM) to estimate the price (value) of the firm's equity

- Using the firm's equity value to assume the firm's asset value and asset volatility, estimate the probability of default (PD) under an assumption that the firm's asset price will follow a lognormal distribution

The Black-Scholes OPM solves for a European call option = S(0)*N(d1) - K*exp(-rT)*N(d2).

- BSM OPM is directly applied only in the first step, to get the firm's equity value (and maybe to get the firm's debt)

- In the second step, N(-d2) is used to estimate PD. It is the same d2, but with one key difference: The riskfree rate (r) in BSM is replaced with a real/physical firm drift (mu). This step uses a component of BSM, so it looks like BSM, but this step is NOT option-pricing at all. It is a simple statistical calculation.

Again, N(-d2) is the analog to PD, except real asset drift replaces riskfree rate.

Step 1 (derivatives valuation): price firm equity like a call option: The first step above employs the BSM OPM precisely because its central insight is to treat the firm's equity as a call option on the firm's assets. In this way:

- S(0) is replaced by today's firm asset value, V(0), where V(0) = D(0) + E(0);

i.e., S(0) in BSM replaced by --> V(0) in Merton - The face value of all debt (not "default threshold" here, that's step 2) replaces the strike price; it's total face value of debt because that is the "strike" that must be paid to retire debt and own the firm's assets.

i.e., K or X in BSM replaced by --> F(t) in Merton - We retain the risk-free rate (r) in this step, we do not use the firm's (asset's) expected return. This is theoretically significant: by employing BSM to price equity as a call option, we rely on the brilliant risk-neutral valuation idea, which requires the risk-free rate as the option payoff can be synthesized with riskless certainty.

i.e., riskfree rate (r) in BSM is retained in Merton

- The Familiar BSM OPM which prices a call option on asset: c(0) = S(0)*N(d1) - K*exp(-rT)*N(d2), is re-purposed to:

- Price the firm's equity as if it were an option (strike = debt face value) on firm's assets: E(0) = V(0)*N(d1) - F(t)*exp(-rT)*N(d2)

- 1b. Less important, for FRM exam purposes, is that we solve for the firm's asset value and the firm asset volatility given the firm's equity value and equity volatility. This first step is a simultaneous solution of two equations in two unknowns which produces an assumption for the capital structure (MV of debt + MV of equity = MV of assets) and the firm's asset volatility. This will not matter in the FRM, it is too tedious. You will instead just be given the assumptions for firm (asset) value and firm (asset) volatility.

- 1c. More important is that a similar option-based insight can be used to price the value of the firm's debt: the value of the firm's "risky" debt = risk-free debt - put option on firm's assets with strike equal to same face value of debt, where risk-free debt is face value of debt discounted at the risk-free rate.

An FRM P2 candidate should try understand the relatively simple intuition of this step, which is not option pricing, it is just statistics. See image below (page 15, from video 6c). I am using de Servigny's numbers.

From left-to-right:

- Assume current price of assets (i.e., firm value), V(0) = $12.75

- Assume assets drift at a rate of mu = +5% per annum

- At the end of the period, firm will have an expected future value higher than today, due to positive drift. In this case, V(t) = ~ $13.34

- Assume a future distribution, same assumption we use for equities: log returns are normal --> future prices are lognormal

- If we are going to make a normal/lognormal assumption, we can treat either, but it is easier to treat the normal log returns. Our expected future firm value is +28.8% standard deviations above the default threshold = LN(13.34/10) = 28.8%. As our asset volatility is 9.6%, the implies our expected future firm value will be +3 sigma above the default threshold of $10.

This final step merely produces a standard normal (Z) variable:

LN(13.34/10)/9.6% sigma = Z of ~ 3.0 where 3.0 is the (standardized) distance to default - Under this series of unrealistic assumptions, future insolvency is characterized by a future firm value that is lower than the default threshold of $10; i.e., the area in the tail.

PD = N(-DD) = N(-3.0) ~= 0.13%

- Risk-free rate (r) vs. asset drift (mu): In BSM, N(d2) = risk-neutral Prob[call option expires ITM] and in Merton N(-DD) = risk-neutral Prob[Insolvency; i.e., Asset expires OTM].

BSM risk-neutral d2 = (LN[S(0)/K] + [r - sigma^2/2]*T)/[sigma*SQRT(T)],

but Merton's step 2 wants real-world DD = (LN[V(0)/F(t)] + [mu - sigma^2/2]*T)/[sigma*SQRT(T)] - The usage of risk-free rate (r) in the first step and asset drift (mu) in the second step nicely illustrates Jorion's introductory (Chapter 1) distinction between derivatives pricing versus risk measurement. The 1st step above is derivatives pricing. The 2nd step is risk measurement, which he contrasts in five dimensions: 1. distribution of future values, 2. focused on the tail of the distribution [instead of the center, as in step one], 3. Future value horizon, 4. Requires LESS PRECISION (i.e., approximation), and 5. utilizing an ACTUAL (physical) distribution, rather than a risk-neutral

The more typical approach, above, derives a standard normal Z deviate by assuming log returns are normally distributed: if LN(S2/S1) is normal then S2 is lognormal. As such, the more typical distance-to-default above produced a standardized normal return-based DD of 3.0 = 28.8% continuous return / 9.6% per annum volatility. In BSM, the numerator of d2 is a continuous return, standardized by dividing by the annualized volatility in the denominator, to give a unitless standard normal deviate.

Alternatively, the distance of default can be expressed as a function of the dollar difference between the future firm asset value and the threshold, in this case: $13.34 - $10 = $3.34. And then standardize that by dividing by the volatility to get the alternative distance to default:

- Lognormal price-based DD = [V(t) - Default]/[sigma*V(t)] = ($13.34 - $10) / (9.6% * $13.34) = 2.607

With respect to the exam (I can't judge the testability of any of this, GARP has been uneven here, overall testability may well be low):

- The historical/sample FRM questions tend to query the lognormal price-based DD maybe because it's a shorter formula: [$V(t) - $DefaultPoint]/[sigma*$V(t)]. You'll notice you can't easily retrieve the inverse lognormal CDF, so naturally this sort of questions only asks you the DD and stops short of asking for the PD.

- You can confirm with an understanding of the above that this formula wants:

1. Expected future asset value (end of period equity + debt), and

2. The dollar volatility of V(t) is more correct than dollar volatility today [i.e., sigma*V(0)] but either is okay. - In the simple two-class Merton, MV equity + MV debt = MV of firm assets, V(0) or V(t) ... and debt directly informs the default threshold ... but, otherwise, this DD is entirely a function of firm assets, not equity: asset value today, V(0), drifting at the asset return (mu) to the future expected asset value, V(t), subject to asset volatility, sigma(asset).

The two steps above illustrate the Merton as (i) assuming the firm will default upon insolvency, asset(t) < face value of all debt(t) and (ii) inferring the area in insolvency tail as a function of a normal return (lognormal price) asset distribution. The KMV method, who I consulted to years ago, recognizes and addresses these two unrealistic assumption.

- First, debt consists of short-term obligations (including the short-term portion of long-term debt) and long-term debt. A firm has more time to recover with respect to the long-term debt. KMV's research led it to conclude that the default threshold point is really somewhere in between the short-term debt and the total debt. So, if LT/ST < 1.5, the default threshold = short-term debt + 0.5 * long-term debt.

- Second, as discussed above, the use of PD = N(-DD) assumes the asset log returns are normally distributed. Let me restate that in, I think, a more meaningful way: by using only the asset volatility, the Merton model tacitly assumes a lognormal distribution of the asset value. As always, this is probably incredibly unrealistic. So, rather than derivate the PD parametrically (i.e., inferring PD as the area under a parametric [lognormal] distribution), KMV resorts to history. Their historical database contains actual firms and their default rates; by back-computing the historical distance-to-defaults, they have a historical correspondence (mapping) of DDs and the actual default rates. For example, whereas parametric normal/lognormal tells us (above) that + 3.0 DD = 0.13% PD (area in the tail), maybe their database shows that +3.0 DD corresponds more nearly to a 0.42% default rate. So, this is a historical empirical translation of DD into PD.

Last edited:

) is the formula that I gave above (the same one that you used for lognormal DD) ever used for regular DD? I have seen "expected value of the assets" given in terms of simple growth (if u =8%, then expected value of the assets is just 1.08* present asset, or firm, value) and also just as "expected return on assets is $20M", so that the term is just $20M.

) is the formula that I gave above (the same one that you used for lognormal DD) ever used for regular DD? I have seen "expected value of the assets" given in terms of simple growth (if u =8%, then expected value of the assets is just 1.08* present asset, or firm, value) and also just as "expected return on assets is $20M", so that the term is just $20M. ) I try to ask only questions that have not been answered before.

) I try to ask only questions that have not been answered before.