Learning objectives: Identify the sources of foreign exchange trading gains and losses. Calculate the potential gain or loss from a foreign currency denominated investment. Explain balance-sheet hedging with forwards.

Questions:

502.1. Sun Bank USA purchased a 16.0 million one-year euro loan that pays 7.0% interest annually. The spot rate of U.S. dollars per euro is $1.10. Sun Bank has funded this loan by accepting a British pound-denominated deposit for the equivalent amount and maturity at an annual rate of 5.0%. The current spot rate of U.S. dollars per British pound is $1.60. At the end of the year, assume the euro depreciates such that the spot rate of U.S. dollars per euro falls to $1.00. Which is nearest to the required spot rate of U.S. dollars per British pound at the end of the year, in order for the bank to earn a net interest margin of 2.0%? (note: this is a variation on Saunders' Question #11)

a. $1.40 per £1; i.e., GPBUSD

b. $1.50

c. $1.60

d. $1.70

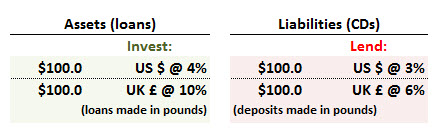

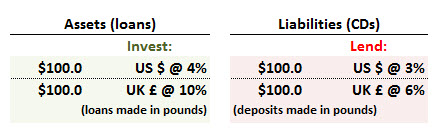

502.2. Suppose that a U.S. financial institution has $200.0 million in assets at the start of the year. Half of its assets are invested domestically in US loans, while the other $100.0 million is invested abroad in the United Kingdom. The (default risk-free) US loans yield 4.0% and the (default-free) loans in the United Kingdom, which denominated in pound sterlings, yield 10.0%:

This institution employs what Saunders calls an "on-balance sheet hedge;" it hedges by matching the maturity and currency of its foreign asset-liability book. The promised one-year U.S. CD rate is 3.0%, to be paid in dollars at the end of the year. The institution funds the British loans with $100.0 million equivalent one-year pound CDs at a rate of 6.0%. The exchange rate of dollars for pounds at the beginning of the year is $1.60/£1; i.e., GBPUSD $1.60. At the end of the year, assume the pound sterling plummets (depreciates) against the dollar to $1.20. Which is nearest to the implied net interest margin ? (note: variation on Saunders' Question #16)

a. -3.75%

b. -0.84%

c. +2.00%

d. +3.33%

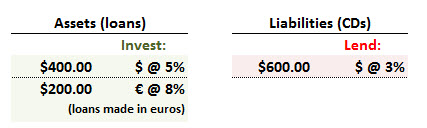

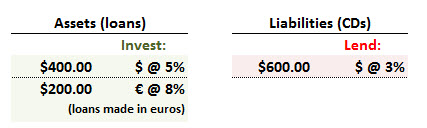

502.3. Suppose the a U.S. financial institution has $600.0 million in assets, at the start of the year, which are funded by US certificates of deposit (CDs) with a promised one-year of 3.0%. The institution invests $400.0 million domestically in U.S. loans that yield 5.0% and the remaining $200.0 million are invested abroad in euro-denominated loans that yield 8.0%:

Rather than match foreign asset position with liabilities (i.e., on balance sheet hedging), the institution uses the forward FX market to employ an off-balance-sheet hedge. The exchange rate of dollars for euros at the beginning of the year is $1.15/€1. The current forward one-year exchange rate between dollars and euros is $1.12/€1; that is, the forward trades at a $0.03 discount to the spot FX rate. Which is nearest to the net interest margin over the year?

a. 1.52%

b. 2.06%

c. 3.00%

d. 4.17%

Answers here:

Questions:

502.1. Sun Bank USA purchased a 16.0 million one-year euro loan that pays 7.0% interest annually. The spot rate of U.S. dollars per euro is $1.10. Sun Bank has funded this loan by accepting a British pound-denominated deposit for the equivalent amount and maturity at an annual rate of 5.0%. The current spot rate of U.S. dollars per British pound is $1.60. At the end of the year, assume the euro depreciates such that the spot rate of U.S. dollars per euro falls to $1.00. Which is nearest to the required spot rate of U.S. dollars per British pound at the end of the year, in order for the bank to earn a net interest margin of 2.0%? (note: this is a variation on Saunders' Question #11)

a. $1.40 per £1; i.e., GPBUSD

b. $1.50

c. $1.60

d. $1.70

502.2. Suppose that a U.S. financial institution has $200.0 million in assets at the start of the year. Half of its assets are invested domestically in US loans, while the other $100.0 million is invested abroad in the United Kingdom. The (default risk-free) US loans yield 4.0% and the (default-free) loans in the United Kingdom, which denominated in pound sterlings, yield 10.0%:

This institution employs what Saunders calls an "on-balance sheet hedge;" it hedges by matching the maturity and currency of its foreign asset-liability book. The promised one-year U.S. CD rate is 3.0%, to be paid in dollars at the end of the year. The institution funds the British loans with $100.0 million equivalent one-year pound CDs at a rate of 6.0%. The exchange rate of dollars for pounds at the beginning of the year is $1.60/£1; i.e., GBPUSD $1.60. At the end of the year, assume the pound sterling plummets (depreciates) against the dollar to $1.20. Which is nearest to the implied net interest margin ? (note: variation on Saunders' Question #16)

a. -3.75%

b. -0.84%

c. +2.00%

d. +3.33%

502.3. Suppose the a U.S. financial institution has $600.0 million in assets, at the start of the year, which are funded by US certificates of deposit (CDs) with a promised one-year of 3.0%. The institution invests $400.0 million domestically in U.S. loans that yield 5.0% and the remaining $200.0 million are invested abroad in euro-denominated loans that yield 8.0%:

Rather than match foreign asset position with liabilities (i.e., on balance sheet hedging), the institution uses the forward FX market to employ an off-balance-sheet hedge. The exchange rate of dollars for euros at the beginning of the year is $1.15/€1. The current forward one-year exchange rate between dollars and euros is $1.12/€1; that is, the forward trades at a $0.03 discount to the spot FX rate. Which is nearest to the net interest margin over the year?

a. 1.52%

b. 2.06%

c. 3.00%

d. 4.17%

Answers here: