You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

YouTube P1.T3. Financial Markets & Products Robert McDonald, Derivatives Markets

- Thread starter tushijima

- Start date

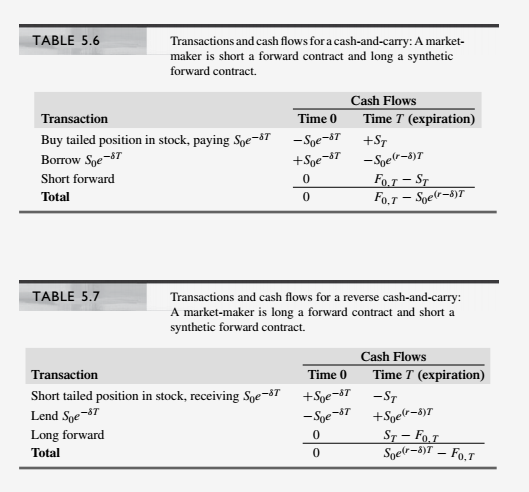

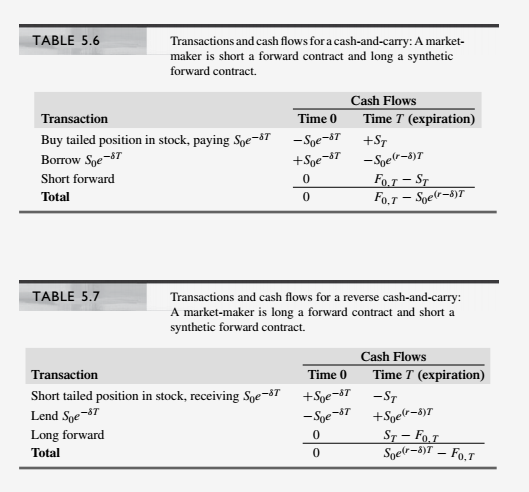

Hi @tushijima Please see McDonald's Table 5.6 & 5.7 below. The $9.90 in my example is given by S(0)*exp(-δ*T) = $10.00*exp(-1.0%*1.0) = $9.90 where 1.0% is the lease rate, which itself is given by δ = α - g = 6.0% discount rate - 5.0% expected growth rate. Here is the XLS: https://www.dropbox.com/s/l0l2vnbaq6mijp5/082719-carry-arb.xlsx. Thanks!

cc @Nicole Seaman this refers to an older YouTube video (2010) that is not among our recent playlists, it is located at

... so i wasn't able to move this thread

cc @Nicole Seaman this refers to an older YouTube video (2010) that is not among our recent playlists, it is located at

Last edited by a moderator:

Similar threads

- Sticky

- Replies

- 3

- Views

- 1K

- Replies

- 0

- Views

- 209

- Replies

- 0

- Views

- 232

- Replies

- 0

- Views

- 111