AIMs: Describe the key rate exposure technique in multi-factor hedging applications and summarize its advantages and disadvantages. Calculate the key rate exposures for a given security, and compute the appropriate hedging positions given a specific key rate exposure profile.

Questions:

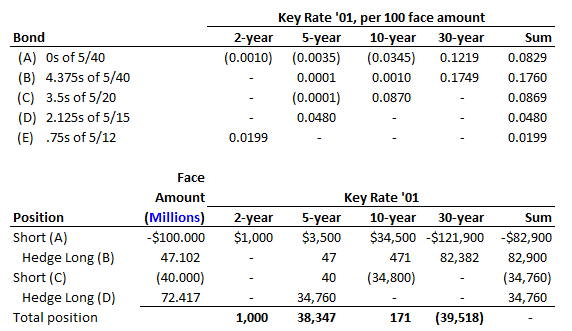

319.1. The first panel below shows the key rate '01 (KR01) for five bonds, bond (A) to (E), and the sum of the four KR01s in the final column. The second panel, which is essentially similar to Tuckman's case study, shows the result of a position that consists of four trades: (Tuckman's case study: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

a. The position is approximately neutral with respect to DV01; i.e., position is ~ DV01-neutral

b. The position has on a substantial 5-30 steepener: it will gain if 30-year yields rise relative to 5-year yields

c. An additional trade to short $5.03 million of face amount of bond (E) will approximately hedge the two-year key rate '01 of the position

d. An additional trade to short $64.38 million of face amount of bond (E) will approximately hedge the five-year key rate '01 of the position

319.2. An underlying exposure (position) has a five-year key-rate '01 of +$23,970. If this key rate exposure can be hedged by trading five-year bond that itself has a 5-year KR01 of $0.0480 per 100 face amount, what is the hedge trade?

a. Buy ~ $499,375 in face amount

b. Buy ~ $49.94 million in face amount

c. Sell ~ $499,375 in face amount

d. Sell ~ $49.94 million in face amount

319.3.In regard to a key rate exposure profile where the key rate type is par yields, which of the following statements is TRUE?

a. If trades neutralize all of the key rate exposures (KR01), then the yield-based DV01 will be approximately neutralized

b. If trades neutralize the yield-based DV01, then each of the key rate exposures (KR01s) will be approximately neutralized

c. A negative key rate exposure must be the result of a short position and cannot be the result of a long position

d. If a coupon-bearing bond has a maturity of exactly five (5) years and prices exactly at par, each of its KR01s will equal its yield-based DV01; i.e., 2-year KR01 = 5-year KR01 = 10-year KR01 = 30-year KR01 = yield-based DV01

Answers:

Questions:

319.1. The first panel below shows the key rate '01 (KR01) for five bonds, bond (A) to (E), and the sum of the four KR01s in the final column. The second panel, which is essentially similar to Tuckman's case study, shows the result of a position that consists of four trades: (Tuckman's case study: Bruce Tuckman, Fixed Income Securities, 3rd Edition (Hoboken, NJ: John Wiley & Sons, 2011))

- A trader shorts $100.0 million face amount of bond (A) for a customer and then hedges this with a long position in $47.102 million face amount of bond (B),

in order to neutralize yield-based DV01. - The trader shorts $40.0 million of bond (C) for a customer then hedges this with a long position in $72.417 face amount of bond (D), again in order to neutralize yield-based DV01:

a. The position is approximately neutral with respect to DV01; i.e., position is ~ DV01-neutral

b. The position has on a substantial 5-30 steepener: it will gain if 30-year yields rise relative to 5-year yields

c. An additional trade to short $5.03 million of face amount of bond (E) will approximately hedge the two-year key rate '01 of the position

d. An additional trade to short $64.38 million of face amount of bond (E) will approximately hedge the five-year key rate '01 of the position

319.2. An underlying exposure (position) has a five-year key-rate '01 of +$23,970. If this key rate exposure can be hedged by trading five-year bond that itself has a 5-year KR01 of $0.0480 per 100 face amount, what is the hedge trade?

a. Buy ~ $499,375 in face amount

b. Buy ~ $49.94 million in face amount

c. Sell ~ $499,375 in face amount

d. Sell ~ $49.94 million in face amount

319.3.In regard to a key rate exposure profile where the key rate type is par yields, which of the following statements is TRUE?

a. If trades neutralize all of the key rate exposures (KR01), then the yield-based DV01 will be approximately neutralized

b. If trades neutralize the yield-based DV01, then each of the key rate exposures (KR01s) will be approximately neutralized

c. A negative key rate exposure must be the result of a short position and cannot be the result of a long position

d. If a coupon-bearing bond has a maturity of exactly five (5) years and prices exactly at par, each of its KR01s will equal its yield-based DV01; i.e., 2-year KR01 = 5-year KR01 = 10-year KR01 = 30-year KR01 = yield-based DV01

Answers: