Hi David,

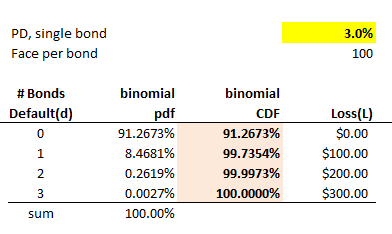

Concerning PQ 29.1 VaR Coherent risk measure ,I do not understand the reasoning about Prob of zero default=[95%^3].Is alpha considered as the prob that the bond will not default?

Given the PD bond, I'm tempted to measure the prob of no default as [1-PD].

Thank you very much four your help.

PS.i make mistake in the thread name.i mean VaR,not ES...I'm unable to modify it.sorry

Concerning PQ 29.1 VaR Coherent risk measure ,I do not understand the reasoning about Prob of zero default=[95%^3].Is alpha considered as the prob that the bond will not default?

Given the PD bond, I'm tempted to measure the prob of no default as [1-PD].

Thank you very much four your help.

PS.i make mistake in the thread name.i mean VaR,not ES...I'm unable to modify it.sorry

:

: