You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

P2 Instructional Video: Bodie, Chapter 24

- Thread starter CFO2013

- Start date

Hi @CFO2013 I think you refer to Bodie's formula 24.6:

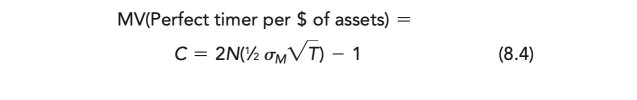

So *apparently* if we assume S = 1 and X = e(rt), then BSM call option (c) = S*N(d1) - K*exp(-rT)*N(d2) simplifies to C = 2N[0.5*σ(M)*sqrt(T)] - 1. (I haven't checked it but appears reasonable given the canceling it implies). I hope that helps, thanks,

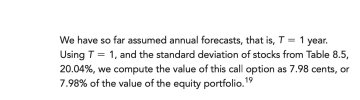

"Because the ability to predict the better-performing investment is equivalent to holding a call option on the market, in any given period, when the risk-free rate is known, we can use option-pricing models to assign a dollar value to the potential contribution of perfect timing ability. This contribution would constitute the fair fee that a perfect timer could charge investors for his or her services. Placing a value on perfect timing also enables us to assign value to less-than-perfect timers. The exercise price of the perfect-timer call option on $1 of the equity portfolio is the final value of the T-bill investment. Using continuous compounding, this is $1 * exp(rt). When you use this exercise price in the Black-Scholes formula for the value of the call option, the formula simplifies considerably to: MV(Perfect timer per $ of assets) = C = 2N[0.5*σ(M)*sqrt(T)] - 1"

So *apparently* if we assume S = 1 and X = e(rt), then BSM call option (c) = S*N(d1) - K*exp(-rT)*N(d2) simplifies to C = 2N[0.5*σ(M)*sqrt(T)] - 1. (I haven't checked it but appears reasonable given the canceling it implies). I hope that helps, thanks,

Oh, yes, I see now, very cool, thank you!

Shau_2207

Member

Hello All, Can anyone please help an example?

@Shau_2207 which example?Hello All, Can anyone please help an example?

Shau_2207

Member

I found an example of MV(Perfect timer per $ of assets) in GARP book see attached but i am not able to figure out the working or calculation 2N, do we need to multiple N value , is the N value right tail or left tail?

Can you please help?

Can you please help?

Attachments

@Shau_2207 This expression is a result of simplification. Please see David's comment above (april 17 and 18, 2014). In short, equity is a call option on asset.

starting point: S(V,F,T,t) = VN(d1) - Pt(T)FN(d2).

on page 238/340 of your ebook (BT notes), you will see it is using an analogy that market timing is just like holding a call option

starting point: S(V,F,T,t) = VN(d1) - Pt(T)FN(d2).

on page 238/340 of your ebook (BT notes), you will see it is using an analogy that market timing is just like holding a call option

Similar threads

- Locked

- Sticky

- Replies

- 27

- Views

- 4K

- Replies

- 0

- Views

- 143

- Replies

- 0

- Views

- 151

- Replies

- 0

- Views

- 297