Suzanne Evans

Well-Known Member

AIMs: Explain the role of interest rate expectations in determining the shape of the term structure. Apply a risk-neutral interest rate tree to assess the effect of volatility on the shape of the term structure.

Questions:

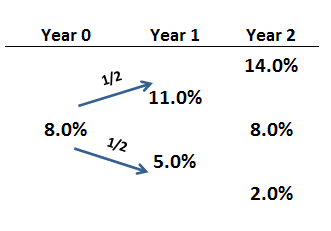

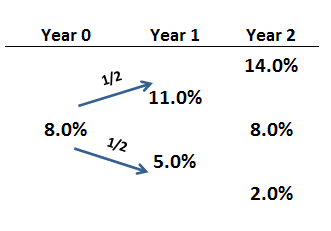

300.1. The interest rate tree below shows the true process for a one-year interest rate. Specifically, the current one-year spot rate is 8.0%. Next year, investors expect the one-year rate to either increase to 11.0% or drop to 5.0%, with equal probability of an increase or drop. Similarly, in in the subsequent year (Year 2), investors expect the future one-year rate to again either increase or decrease, with equal likelihood by 3%. Graphically, as follows:

In this way, we assume that investors do completely understand the volatility around their expectations of the future one-year spot interest rate. Further, assume that investors are risk-neutral such that they price securities according to the expected discounted value. Which is nearest to the consequent price of a two-year zero-coupon $1,000 par bond?

a. $854.80

b. $858.00

c. $905.24

d. $1,000.00

300.2. Each of the following is TRUE about the shape of the term structure of spot interest rates EXCEPT for:

a. If all investors agree with certainty that the current one-year spot rate of 1.0% will increase to 2.0% next year and again to 3.0% in two years, the three-year spot rate should be almost 2.0% (with annual compounding)

b. It is unreasonable and impractical to expect pure (and strict or narrow) expectations theory to fully characterize the term structure in practice

c. Although investors' expectations about short-term rates have little or no impact on the SHAPE of the term structure, they tend to dominate its SHAPE over longer time horizons (e.g., 20 or 30 years)

d. Under an assumption of pure expectations, it is valid to hypothesize (infer) from a downward-sloping term structure that investors are forecasting a drop in future short-term (e.g., one year) interest rates

300.3. Let us make two dubious assumptions. First, that investors are risk-neutral; i.e., there is no risk premium in the term structure. Second, investors do know or "understand" volatility in the sense that they agree on a binomial interest rate tree. Under these assumptions, what is the impact of higher volatility on the term structure?

a. If expected future short-term interest rates are unchanged, greater interest rate volatility has no impact

b. It is unclear as convexity has a directionally different impact at low yields than at high yields

c. Higher volatility will increase the yield and decrease bond prices due to the convexity effect

d. Higher volatility will decrease the yield and increase bond prices due to the convexity effect

Answers:

Questions:

300.1. The interest rate tree below shows the true process for a one-year interest rate. Specifically, the current one-year spot rate is 8.0%. Next year, investors expect the one-year rate to either increase to 11.0% or drop to 5.0%, with equal probability of an increase or drop. Similarly, in in the subsequent year (Year 2), investors expect the future one-year rate to again either increase or decrease, with equal likelihood by 3%. Graphically, as follows:

In this way, we assume that investors do completely understand the volatility around their expectations of the future one-year spot interest rate. Further, assume that investors are risk-neutral such that they price securities according to the expected discounted value. Which is nearest to the consequent price of a two-year zero-coupon $1,000 par bond?

a. $854.80

b. $858.00

c. $905.24

d. $1,000.00

300.2. Each of the following is TRUE about the shape of the term structure of spot interest rates EXCEPT for:

a. If all investors agree with certainty that the current one-year spot rate of 1.0% will increase to 2.0% next year and again to 3.0% in two years, the three-year spot rate should be almost 2.0% (with annual compounding)

b. It is unreasonable and impractical to expect pure (and strict or narrow) expectations theory to fully characterize the term structure in practice

c. Although investors' expectations about short-term rates have little or no impact on the SHAPE of the term structure, they tend to dominate its SHAPE over longer time horizons (e.g., 20 or 30 years)

d. Under an assumption of pure expectations, it is valid to hypothesize (infer) from a downward-sloping term structure that investors are forecasting a drop in future short-term (e.g., one year) interest rates

300.3. Let us make two dubious assumptions. First, that investors are risk-neutral; i.e., there is no risk premium in the term structure. Second, investors do know or "understand" volatility in the sense that they agree on a binomial interest rate tree. Under these assumptions, what is the impact of higher volatility on the term structure?

a. If expected future short-term interest rates are unchanged, greater interest rate volatility has no impact

b. It is unclear as convexity has a directionally different impact at low yields than at high yields

c. Higher volatility will increase the yield and decrease bond prices due to the convexity effect

d. Higher volatility will decrease the yield and increase bond prices due to the convexity effect

Answers: