Questions:

406.1. Each of the following is a traditional distinction of a hedge fund manager and therefore likely describes a hedge fund manager, except which most likely also refers to a mutual fund manager? In other words, which of the following statements MOST likely refers to a mutual fund manager?

a. Her peer (and/or peer index) comparison suffers from survivorship bias

b. Her compensation is "2 and 20;" i.e., management fee of 2% of assets plus a 20% incentive fee

c. She has a unrestricted flexibility in trading, including the ability to sell short, enter derivatives and employ leverage

d. Her investor can redeem monthly or quarterly but not sooner; e.g., they cannot redeem daily

406.2. Which of the following is true (or most likely to be true among the choices) about an equity market neutral hedge fund?

a. The fund is a strong candidate for an investor's entire retirement portfolio

b. The fund is a strong candidate to provide portable alpha (via alpha transfer) to complement beta-type exposure supplied by an exchange-traded fund (ETF)

c. By definition, the fund should have a Treynor measure approximately equal to zero

d. If executed correctly, the fund should provide a genuine (i.e., technically valid) risk-free arbitrage strategy

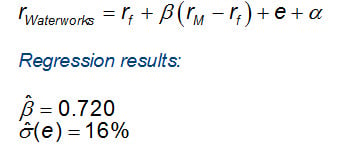

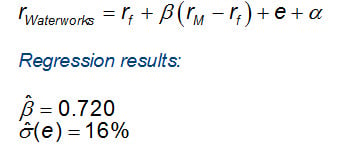

406.3. Assume the return of Waterwork's stock is given by the capital asset pricing model (CAPM):

This return includes a residual component (e) for the firm-specific (i.e., non-systematic) risk plus an alpha that reflects perceived mis-pricing. Betty the hedge fund manager believes that Waterworks is underpriced, with an alpha of 3.0% over the coming month. She has regressed the monthly returns on Waterworks stock against the S&P 500 Index. The regression results include a beta of 0.720 and a standard deviation of the residual, σ(e), of 16.0%. Betty holds a $5.0 million portfolio of Waterworks stock. She wants to fully hedge the market exposure for the next month using 1-month maturity S&P 500 futures contracts. The risk-free rate is 1.0% and the S&P 500 is currently trading at 1,800 (contract multiplier is $250). If monthly returns are approximately normal, how many contracts should she sell and what is the probability that this market neutral strategy will lose money over the next month?

a. Short 5.0 contracts and probability of loss is about 83.4%

b. Short 8.0 contracts and probability of loss is about 40.1%

c. Short 15.0 contracts and probability of loss is about 40.1%

d. Short 25.0 contracts and probability of loss is about 17.7%

Answers here:

406.1. Each of the following is a traditional distinction of a hedge fund manager and therefore likely describes a hedge fund manager, except which most likely also refers to a mutual fund manager? In other words, which of the following statements MOST likely refers to a mutual fund manager?

a. Her peer (and/or peer index) comparison suffers from survivorship bias

b. Her compensation is "2 and 20;" i.e., management fee of 2% of assets plus a 20% incentive fee

c. She has a unrestricted flexibility in trading, including the ability to sell short, enter derivatives and employ leverage

d. Her investor can redeem monthly or quarterly but not sooner; e.g., they cannot redeem daily

406.2. Which of the following is true (or most likely to be true among the choices) about an equity market neutral hedge fund?

a. The fund is a strong candidate for an investor's entire retirement portfolio

b. The fund is a strong candidate to provide portable alpha (via alpha transfer) to complement beta-type exposure supplied by an exchange-traded fund (ETF)

c. By definition, the fund should have a Treynor measure approximately equal to zero

d. If executed correctly, the fund should provide a genuine (i.e., technically valid) risk-free arbitrage strategy

406.3. Assume the return of Waterwork's stock is given by the capital asset pricing model (CAPM):

This return includes a residual component (e) for the firm-specific (i.e., non-systematic) risk plus an alpha that reflects perceived mis-pricing. Betty the hedge fund manager believes that Waterworks is underpriced, with an alpha of 3.0% over the coming month. She has regressed the monthly returns on Waterworks stock against the S&P 500 Index. The regression results include a beta of 0.720 and a standard deviation of the residual, σ(e), of 16.0%. Betty holds a $5.0 million portfolio of Waterworks stock. She wants to fully hedge the market exposure for the next month using 1-month maturity S&P 500 futures contracts. The risk-free rate is 1.0% and the S&P 500 is currently trading at 1,800 (contract multiplier is $250). If monthly returns are approximately normal, how many contracts should she sell and what is the probability that this market neutral strategy will lose money over the next month?

a. Short 5.0 contracts and probability of loss is about 83.4%

b. Short 8.0 contracts and probability of loss is about 40.1%

c. Short 15.0 contracts and probability of loss is about 40.1%

d. Short 25.0 contracts and probability of loss is about 17.7%

Answers here: