Hi Everyone !!

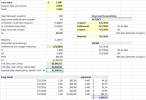

Suppose that at time t = 0, I want to price a bond that pays annual coupon at t = 1, t = 2 and t = 3. Maturity is 3 years. Assume annual compounding for simplicity.

The pricing at time t = 0 should be trivial because I can discount each of the coming 3 cash flows at the 1 year, 2 year and 3 year spot rates.

However, imagine now that 6 months have elapsed, so my cash flows are now due in 0.5, 1.5 and 2.5 years. How should I price this bond now, given that at any point in time, I only have access to the 1 year, 2 year and 3 year spot curve? I cant use them as is because the cash flows are due in 0.5, 1.5 and 2.5 years NOT 1, 2 and 3 years.

Can I just discount the first cash flow at 1 / (1 + 1yr spot) ^ 0.5 because it will occur in 0.5 years?

Similarly, can I discount the second cash flow at 1 / (1 + 2yr spot) ^ 1.5 because it will occur in 1.5 years and not 2 years exactly?

and so on....

Thanks alot

Jamal

Suppose that at time t = 0, I want to price a bond that pays annual coupon at t = 1, t = 2 and t = 3. Maturity is 3 years. Assume annual compounding for simplicity.

The pricing at time t = 0 should be trivial because I can discount each of the coming 3 cash flows at the 1 year, 2 year and 3 year spot rates.

However, imagine now that 6 months have elapsed, so my cash flows are now due in 0.5, 1.5 and 2.5 years. How should I price this bond now, given that at any point in time, I only have access to the 1 year, 2 year and 3 year spot curve? I cant use them as is because the cash flows are due in 0.5, 1.5 and 2.5 years NOT 1, 2 and 3 years.

Can I just discount the first cash flow at 1 / (1 + 1yr spot) ^ 0.5 because it will occur in 0.5 years?

Similarly, can I discount the second cash flow at 1 / (1 + 2yr spot) ^ 1.5 because it will occur in 1.5 years and not 2 years exactly?

and so on....

Thanks alot

Jamal