Hello,

i have the following question:

1. The joint probability for two independent events is defined as: P(A and B)=P(A)xP(B)

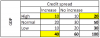

2. Why is not P(High=20%)xP(Increase=40%)=P(Increase and High=10%).

Or should it be and only the example is wrong?

Can anybody explain it please?

I wish all of you a nice Sunday evening.

i have the following question:

1. The joint probability for two independent events is defined as: P(A and B)=P(A)xP(B)

2. Why is not P(High=20%)xP(Increase=40%)=P(Increase and High=10%).

Or should it be and only the example is wrong?

Can anybody explain it please?

I wish all of you a nice Sunday evening.