Welcome to the latest week in financial education (WIFE)! As the May exams have started, we experienced another busy week. We are grateful for some fabulous contributions by members (see links below). At this time of year, many candidates are naturally focused on practice question revision, not just from our database but also other sources like GARP's Practice Exams. This always elicits informative feedback on the issue of question quality. We are constantly reminded that Imprecise or poorly worded questions prove to be debatable (or at least confusing) when they are stress tested. In the worst case, a flawed question can actually reinforce a mental mistake. GARP's question about a repo transaction (link below) is a fine example. This is a question that GARP had already revised twice in 2016-17 due to imprecisions but even their updated version could be improved. My strong belief is that a good question should not make the candidate struggle to interpret any input assumption (e.g., is the given bond price a quote price or an invoice price?); given limited time, it is hard enough to perform the calculation required by the question.

I hope you like this week's new practice questions. The new correlations (Chapter 12) set should give you good coverage on some useful techniques: The Jarque-Bera test of normality, the power law for heavy-tail distributions, and a low-difficulty quiz asking you to find rank (Spearman's and Kendall's tau) correlations. The latter (rank correlations) is also a concept in Topic 5 (Part 2, Market Risk) where we had the pleasure of contributing an edit to FRM author Gunter Meissner's book (see https://trtl.bz/2rseaBT for details). If you happen to be a visual thinker like me, here is how I handle concordant/discordant pairs, it's simple: concordant pairs lie in the first (I) or third (III) quadrant https://trtl.bz/3y76ans. About the portfolio construction question set, I calibrated them as approachable; as we've often observed, the weakness of this reading assignment (Grinold Chapter 14) is the lack of scaffolding: the material presumes you've read prior chapters in the book. Have a good study week!

New Practice Question Sets

I hope you like this week's new practice questions. The new correlations (Chapter 12) set should give you good coverage on some useful techniques: The Jarque-Bera test of normality, the power law for heavy-tail distributions, and a low-difficulty quiz asking you to find rank (Spearman's and Kendall's tau) correlations. The latter (rank correlations) is also a concept in Topic 5 (Part 2, Market Risk) where we had the pleasure of contributing an edit to FRM author Gunter Meissner's book (see https://trtl.bz/2rseaBT for details). If you happen to be a visual thinker like me, here is how I handle concordant/discordant pairs, it's simple: concordant pairs lie in the first (I) or third (III) quadrant https://trtl.bz/3y76ans. About the portfolio construction question set, I calibrated them as approachable; as we've often observed, the weakness of this reading assignment (Grinold Chapter 14) is the lack of scaffolding: the material presumes you've read prior chapters in the book. Have a good study week!

New Practice Question Sets

- P1.T2.21.4. Non-normal distributions and rank correlations http://trtl.bz/BT-P2-T2-21-4-Non_normal

- P2.T9.21.4 Portfolio construction: neutralized alphas and dispersion http://trtl.bz/P2-T9-21-4-Portfolio_alpha

- [P1.T2] Generalized student's t versus student's t https://trtl.bz/3f0VE8m

- [P1.T3] Thank you @librosdeholanda for noticing our question should refer to a trading strategy profit rather than payoff https://trtl.bz/3nYzXde

- [P1.T3] Thank you @lushukai for helpful swap pricing observations https://trtl.bz/33r0YfQ

- [P1.T3] Thank you @shuffleshoe for correcting an imprecision in our strap ROI question https://trtl.bz/3vUpMt2

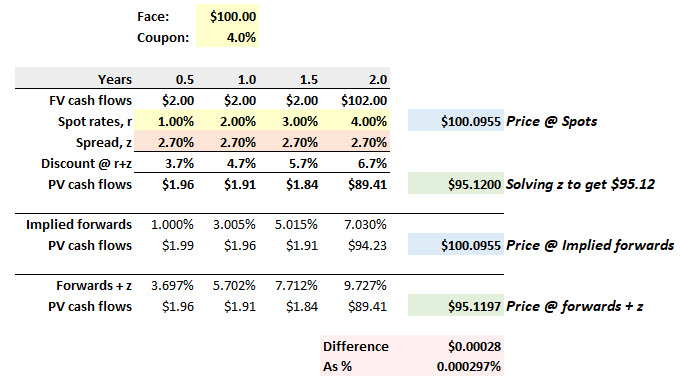

- [P1.T4] @Jagan.Ganti with a great observation that forward spreads aren't exactly equal to spot spreads https://trtl.bz/3eCgyff

- [P1.T4] Which makes more efficient use of data, parametric VaR or historical simulation (HS) VaR? https://trtl.bz/3uA9dSH

- [P1.T5] A common issue encountered when using the normal approximation of the binomial VaR backtest: CLT or not? https://trtl.bz/2RFl9E4 and a similar application here https://trtl.bz/3hc8seT

- [P2.T8] The unfair cognitive load of an imprecise repo question https://forum.bionicturtle.com/threads/garp-2021-pre-study-pack-q2-repo.23813/ and its antecedent from the 2020 Part 2 Practice Exam https://forum.bionicturtle.com/threads/garp-2020-practice-exam-part-2-q74.23268/

- [P2.T9] @sohinichowdhury offers a more elegant M^2 formula https://trtl.bz/3hekmF1

- [P2.T9] Thank you @badbunny for calculator assistance https://trtl.bz/3ybTgEG

- [P2.T9] What is a realistically high/low R^2 in empirical finance? https://trtl.bz/33wYH2R

- 2021 The State of Risk Oversight: ERM Practices - 12th Edition https://trtl.bz/3uEFfNt Comments by Norman Marks https://trtl.bz/3o7wFVc

- Protiviti’s 2021 Next-Generation Internal Audit Survey https://trtl.bz/3eA3xmk (report here)

- Risk Appetite and Risk Tolerance (Which definitions do you use?) by Carol Williams https://www.erminsightsbycarol.com/risk-appetite-tolerance-definitions/

- GARP Intelligence: High-Frequency Trading: A Sociologist’s Take https://trtl.bz/3f4INlK and What’s Next? A Guide to Managing Inflation Risk https://trtl.bz/3vSAujy

- G20 TechSprint 2021 https://www.bis.org/hub/2021_g20_techsprint.htm Site is here https://www.techsprint2021.it/

- Sea level rise uncertainties: Why all eyes are on Antarctica https://trtl.bz/3xTWufI

Last edited by a moderator: