Hend Abuenein

Active Member

Hi David,

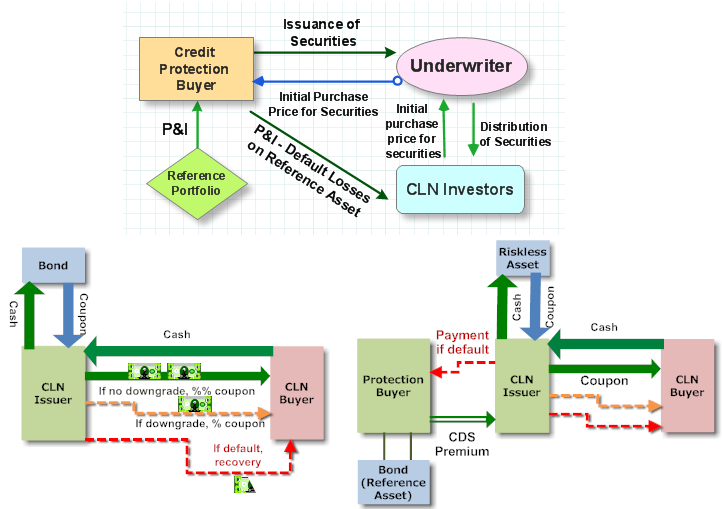

Would you please give an example to clarify what CLNs are? But please give parties of example names, all examples I found called them buyer, issuer and seller. For this kind of credit derivatives only I confuse them together.

Also, I don't understand in CLNs whose default risk is being mitigated, and who is bearing that risk.

Thank you

Would you please give an example to clarify what CLNs are? But please give parties of example names, all examples I found called them buyer, issuer and seller. For this kind of credit derivatives only I confuse them together.

Also, I don't understand in CLNs whose default risk is being mitigated, and who is bearing that risk.

Thank you

but I think you'll explain all in a good example..like you always do

but I think you'll explain all in a good example..like you always do